No single country plays a larger role in Australia's economy than the United States. The United States is not only Australia's second largest trading partner, it is by far the largest investor in Australia and an unparalleled provider of the capital required to fuel our economy.

While Australia's trade relationships, particularly in the region, are vital to continued growth and prosperity, the United States remains Australia's indispensable economic partner.

Australia has always been a heavy importer of foreign capital. That foreign capital is a crucial driver of employment, economic growth, and also the ability to export. Ultimately, foreign investment facilitates Australia's trading relationships by providing the necessary capital and knowhow for production of goods and services.

Taking a multi-pronged approach, the United States Studies Centre's report of the Australia-US investment relationship analysed this vital relationship from a variety of angles. The inquiry evaluates the depth and importance of the investment relationship while also highlighting the diverse challenges that lie ahead.

The broad relationship

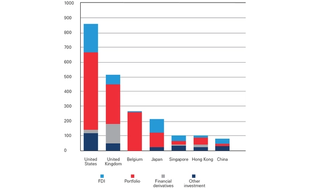

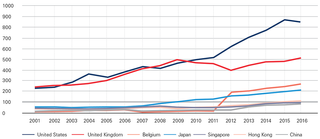

The cumulative value of two-way investment between the United States and Australia is more than $1.47 trillion, a number nearly as large as Australia's gross domestic product. Representing more than a quarter of all foreign investment in Australia for many decades, the cumulative stock of US investment in Australia is currently $860 billion: that's $345 billion more than the next largest investor, the United Kingdom, and approximately 10 times more than Chinese investment in Australia.

The total stock of US foreign direct investment (FDI) in Australia is $195 billion – more than twice the amount of any other country. Critical sources of economic growth, these investments span all sectors of the economy and are responsible for more than 330,000 high-paying jobs with US-affiliated firms in Australia (average salary more than $115,000), annual capital expenditures of more than $10 billion, and annual research and development spending of more than $1 billion since 2009.

What does investment in Australia look like?

Foreign investment in Australia broadly takes four different forms: direct investment, portfolio investment, financial derivatives, and other investments. Foreign direct investment, defined as foreign ownership of 10 per cent or more of a company, makes up 24 per cent of total foreign investment in Australia. Foreign portfolio investment, generally defined as foreign ownership of less than 10 per cent of a company, makes up 52 per cent of all foreign investment in Australia. Six per cent of foreign investment in Australia comprises financial derivatives, largely foreign currency hedging and the like, while the remaining 16 per cent is defined as other investments, a residual category that covers any items, such as trade credits, that are not defined elsewhere.

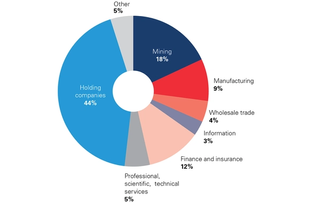

The top sectors attracting US FDI into Australia are holding companies, mining, finance and insurance, and manufacturing. The outsized role of holding companies in US FDI into Australia is actually consistent with the global trend of increasing amounts of US FDI being in the form of holding companies. Tasked with holding securities or assets of other companies, many organisations engage in the use of holding companies for overseas investment for tax considerations.

Investment in both directions

The US-Australia investment relationship is certainly not a one-way street. The United States has long been the single largest destination of outbound Australian investment, comprising more than a quarter of all Australian overseas investment. Total cumulative Australian investment in the United States is estimated to be $617 billion – more than seven times the $87 billion that Australia has invested in China. More than 1200 Australian firms have operations in the United States, 12 per cent of which have assets or income greater than $US20 million. Australia exports to the United States in 2016 were worth $US9.5 billion – a fraction of the $US60.6 billion that Australian-owned companies in the US made in sales in the same timeframe. Major Australian firms, ranging from biotechnology giants like Resmed to property giants like Westfield Corporation, see the United States not just as a market responsible for more than half of their global revenues, but as a springboard to the world.

The importance of capital markets

Australia is a nation that relies heavily on international capital markets. At a very basic level, Australia needs a continual inbound flow of capital in order for the economy to continue to grow. This is true in both debt and equity markets. Debt matures and must be repaid or rolled over, meaning that the funding needs of the nation are ongoing and significant drivers of economic growth.

The increase in both household and government debt in Australia, particularly in recent years, makes this funding necessity even more pressing.

US capital markets have a critical role in Australia's economy: they are an indispensable source of capital for Australian businesses. The big four banks – with combined market capitalisation totalling nearly a quarter of the ASX 200 – are the most obvious cases in point, given their large wholesale funding requirements. With Australian banks having a foreign funding ratio of 24 per cent, their capacity to access US markets is crucial for their own funding but that, of course, flows directly on to their customers through an increased capacity to provide credit.

In debt and equity markets, and for the vast majority of financial products, US capital markets are the deepest, most liquid, and most reliable for Australian entities, public or private, with funding needs. In 2016, corporate debt issuance in the United States totalled $US1.5 trillion, with total outstanding issuances of $US8.5 trillion. To put that in context, the entire GDP of Australia is around $US1.4 trillion.

Australian households are a huge and clear beneficiary of this. It is not a stretch to say that Australians' mortgages are brought to them by US capital markets.

Challenges to the investment relationship

Immigration

One of the cornerstones of the business model of many firms in Australia is the ability to attract highly-skilled workers of exceptional quality to their Australia operation. Part of what makes Australia an enticing destination for such highly-skilled overseas workers is the presumption they will have security of tenure in the country.

The two-way knowledge transfer that is a critical part of the US-Australia investment relationship is under threat unless continued flows of highly-skilled workers between Australian and US employers are maintained.

While abuse of immigration regulations should be addressed, changes to the 457 visa put that certainty of tenure in doubt, and thus threaten Australia's investment into talent by restricting the flow of highly-skilled overseas workers into Australia.

The two-way knowledge transfer that is a critical part of the US-Australia investment relationship is under threat unless continued flows of highly-skilled workers between Australian and US employers are maintained.

Housing affordability

Innovative firms like Amazon Web Services emphasised that they chose to locate their offices in the CBD of Sydney because the highly skilled employees that they wish to attract wanted to live nearby.

Australia's worsening housing affordability – particularly in the country's most desirable areas within close proximity of the CBDs of Sydney and Melbourne – is a distinct threat to the ability to maintain such investments. Thus, housing affordability can significantly curtail the "lifestyle dividend" that Australia is seen as conferring.

A combination of increasing housing supply (through land releases and changes to zoning regulations, for example), combined with a reduction in demand-side measures (such as preferential tax treatment for investment properties) is required to start adequately fixing this issue.

Investment certainty

Some degree of policy uncertainty is present in every jurisdiction and is, to a certain extent, unavoidable. However, Australia stands out in its uncertainty in many regards, from the hurried implementation of new bank taxes to dramatic reversals in energy policy.

Greater regulatory certainty from government would improve the investment climate to make it more conducive from all sources, particularly FDI.

Tax rates

At 30 per cent, Australia currently has the fifth highest corporate tax rate in the OECD, yet in 2003 had only the 18th highest in the OECD. There is a further trend among developed countries like the United States and the United Kingdom to potentially lower their corporate tax rates by a significant amount.

This makes investing in Australia relatively less attractive, all else being equal, than investing in other jurisdictions. A recognition that financial capital is highly and increasingly mobile is important for continued foreign direct investment in Australia.

Barriers to portfolio investment

Nearly a decade ago, there was a push for greater comity between US and Australian financial markets, with negotiations getting to the point of preliminary agreement on a "mutual recognition framework". The arrangement – signed by and predicated on further co-operation between the US Securities and Exchange Commission and the Australian Securities and Investments Commission – was intended to allow US and Australian stock exchanges and brokers to operate in both jurisdictions without being subject to additional regulations.

Unfortunately, however, US and Australian officials signed preliminary documents mere weeks before the financial crisis began in 2008. This and subsequent leadership changes ultimately resulted in no implementation of a final agreement that was intended to go into effect as early as 2009.

Another barrier to more portfolio investment in Australia is the fact that it is often inadvertently captured by the Foreign Acquisitions and Takeovers Act, therefore necessitating extra scrutiny by FIRB. Major foreign portfolio investors could easily take a sizeable interest in a company that requires FIRB approval yet, as passive investors, not exercise control or even have the desire to exercise control over the company. This is a significant deterrent to foreign portfolio investment. Preliminary discussions on addressing this took place between the United States and Australia as part of the US Free Trade Agreement (which entered into force in 2005) but no final decision was made.

Further progress in reducing transaction costs and creating greater contracting certainty would allow for even more two-way capital flows between the United States and Australia, with concomitant improvements to investment outcomes.

An indispensable economic partnership

Australia's investment relationship with the United States is a vital cornerstone of our national prosperity. It provides access to capital, leads to high-skill job creation, access to the US market for Australian firms, and knowledge transfers. In each of these areas, the United States is Australia's most valuable partner.

Maintaining and developing an invaluable investment relationship requires consolidating some of the important reforms of the past, and resisting populist impulses.