Executive summary

In an era of rapid and potentially disruptive change, an economy’s capacity to develop new enterprises and areas of specialisation is increasingly important. Given that innovation and entrepreneurship are so essential, what roles can, and perhaps should, government organisations and programs have in supporting them?

Although Australia’s research system is strong, its performance in innovation and commercialisation is not. Nor has innovation policy been effective in driving sustained improvement.

Although Australia’s research system is strong, its performance in innovation and commercialisation is not. Nor has innovation policy been effective in driving sustained improvement.

The United States also has a strong research system, but also a strong innovation system with more effective commercialisation. US programs and policies that support commercialisation and technology-based entrepreneurship have been increasingly strengthened over the past 50 years — often in response to perceived challenges to US technological leadership. The rise of Chinese firms and innovation capability is seen as a new challenge and has stimulated a new phase of policy review, debate and perhaps change. In the United States innovation performance matters.

The challenges for effective innovation and commercialisation policy in Australia are different from those in the United States in several respects:

- Industry, research organisations and policy in Australia have been shaped by the earlier period of high protection and the high dependence on commodity exports.

- Australia has a research system that produces high-quality research — but mostly in organisations weakly connected to industry. Hence, levels of collaboration between research and business for innovation are low.

- The central innovation dynamic in Australian industry is technology absorption and adaptation for domestic markets. Australia is, in general, an innovation follower rather than a leader.

- Australia is not a significant player at the international technology frontier and the “innovation system” has a low capacity to generate new areas of international specialisation.

In addition, conceptual lock-in and limited policy learning have contributed to a lack of policy innovation and effectiveness.

In looking for a way out of the Australian innovation malaise, and taking these differences into account, what can we learn from the US approach and experience? We suggest that we can learn from three characteristics of the US approach:

- pragmatic approach to policy design and ongoing adaptation, with a focus on achieving national innovation (rather than research or invention) goals

- a strong focus on innovation objectives at the program level, often based on defined “missions” and public-private partnerships to develop advanced technologies and address bottlenecks that limit industry-wide performance — this approach provides a continuous negotiation between top-down and bottom-up innovation priorities in a context of strong accountability

- a high level of ambition along with a preparedness to support high-risk projects, and withdraw support from those that are not performing

More generally the US policy experience shows that governments can:

- play a major and effective role in facilitating knowledge transfer and value creation from university and public-sector research

- effectively develop approaches, drawing on relevant expertise, that identify research priorities and guide the direction of innovative effort at the level of the innovation system

The US experience suggests that when markets are not effective institutions for supporting entrepreneurship and innovation in emerging technologies and industries, governments need to play the supporting role. That experience also suggests that analysis of international experience and a good understanding of national challenges are better guides to innovation policy than the very limited innovation frameworks based on economic theory.

Drawing on the US experience, and recognising the particular challenges of the Australian context, we propose four initiatives to energise and strengthen the fragmented Australian innovation system:

- Increase direct and selective funding of R&D. The R&D Tax Incentive cannot be the central mechanism of innovation policy where most business R&D is incremental and focused on adaptation of technology.

- Develop ambitious national missions, rather than vague and inclusive “priorities”, to focus investments on innovation and capability-building rather than research.

- Develop Innovation and Science Australia as an innovation agency to develop, fund and manage national innovation missions, based on foresight, road-mapping and extensive consultation.

- Designate a proportion of government funding for R&D, rising over 10 years to at least 10 per cent, to be allocated to high-potential SMEs (firms with less than 250 employees, including start-ups) with clearly defined innovation objectives and capabilities.

Introduction

In 2015 Innovation and Science Australia, an advisory board established by the Australian Government, commissioned a review of Australia’s innovation performance.1 One of its findings was that despite, or perhaps because of, more than 26 years of continuous economic growth, important aspects of Australia’s innovation performance had not significantly improved. Innovation-related collaboration among firms, and particularly between firms and research organisations, remains the lowest or among the lowest in the OECD.2 Business R&D intensity is more than 20 per cent lower than 10 years ago, and government investment in R&D in 2017/18 was 20 per cent lower, as a proportion of GDP, than in the mid-1990s.3

Australia has a strong research system. Raising the level of research-industry collaboration and improving knowledge transfer have been perennial themes of Australian innovation policy. However, performance has improved little over time.

Research-industry collaboration and effective commercialisation have also been strong themes in US innovation policy. The foundation of US policies for innovation, collaboration and commercialisation was developed 40-50 years ago. These policies were designed, and have been strengthened, in response to concerns about innovation performance. Today there is again concern about innovation and commercialisation performance, and the United States has initiated a new round of policy reviews.

It is now timely to assess whether the US approach to research commercialisation has relevance for Australia. The US experience provides insights in three areas: the design of specific commercialisation and collaboration programs, the approach to program governance and management, and the level of realism about impediments to innovation and ambitious outcomes in policy initiatives responding to new objectives.

Unleashing American innovation

The current US administration is turning the spotlight on the commercialisation outcomes of the more than US$150 billion invested each year in research at federal laboratories and federally funded R&D at universities. A cross-agency initiative has been established to review and possibly redesign the approach to technology transfer from government-funded research in universities, and particularly from the many labs of federal agencies such as the Department of Defense, the Department of Health and Human Services, NASA and the Department of Energy. The National Institute of Standards and Technology (NIST) and the White House Office of Science and Technology Policy are jointly leading the initiative.4

The Lab to Market and Return on Investment initiatives clearly respond to perceived challenges to US leadership in key technologies and industries. At a symposium launching the Unleashing American Innovation initiative on 19 April 2018, Wilbur Ross, the Commerce Secretary, expressed concern about other countries more rapidly commercialising technologies developed from US R&D:

For America to maintain its position as the leader in global innovation, bring products to market more quickly, grow the economy, and maintain a strong national security innovation base, it is essential to optimise technology transfer and support programs to increase the return on investment (ROI) from federally-funded R&D.5

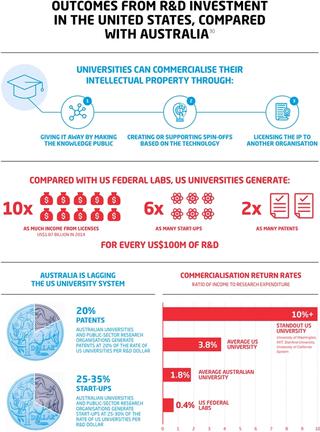

Over the 10 years to 2015 the rate of invention disclosures, patent applications and licences granted to federal labs had been relatively flat, whereas the performance of US universities increased strongly, almost doubling.6 Data from the Association of University Technology Managers and NIST indicates that, on average, US universities generate 10 times as much income from licences and form six times as many start-ups per US$100 million of R&D, compared to federal labs.

Indeed the desire of the US administration to emulate industry is clear from the challenge put to the symposium by Commerce Secretary Ross:

To the directors of federal laboratories … I challenge you to make it clear to your legal, research, and administrative staff, that technology transfer must move as rapidly as industry does.

The Lab to Market and Return on Investment initiatives

The goals of the Lab to Market and Return on Investment initiatives are to strengthen entrepreneurial skills in research organisations, develop more effective forms of collaboration, promote best practice in technology transfer management, increase external innovators’ access to federal R&D facilities, better support small business participation through the use of Small Business Innovation Research (SBIR)7 support, and improve evaluation of impacts through better metrics and reviews.

The initiative aims, through changes in regulation, incentives and processes, to increase private sector investment in later stage R&D and commercialisation. Reviews will include an assessment of the continuing efficacy of the technology transfer laws enacted in the 1980s — the Bayh-Dole Act and the Stevenson-Wydler Act.8

NIST’s “Request for Information Regarding Federal Technology Transfer Authorities and Processes” (RFI) includes a list of what are seen to be systemic challenges to the effective transfer of technology, knowledge and capabilities from federal R&D:9

- inconsistent practices across federal agencies

- difficulty in negotiating intellectual property provisions

- inability to copyright digital products produced by government operated labs

- challenges in protecting trade secrets when federal labs work with private companies

- requirements that force federal employees to leave government service to launch companies

The task force, supported by a number of related groups,10 has invited submissions and held forums across the United States. On 6 December, NIST released a green paper, Return on Investment Initiative for Unleashing American Innovation,11 with draft recommendations. They expect to release a final version in early 2019. The green paper proposes 15 ‘actions’ that aim to drive a pro-active approach to commercialisation within federal labs, increase incentives for federal employees to participate in commercialisation, including through ‘entrepreneurial leave’, and to increase the scope for public-private partnerships.

Walter Copan, director of NIST, has said that “It’s now time for a fresh look at how we do federal technology transfer [with the goal being to] streamline, simplify, and open up more of the doors of our federal laboratories and federally-funded research at universities to have greater impact on the US economy”. However, it is hard to see the scope for changes as transformative as those of the 1980s.12

Challenges from China

In 2015 China announced the Made in China 2025 policy,13 with its strategy being to develop leading positions in 10 emerging knowledge and technology intensive (KTI)14 industries. This ambitious plan suggests a new level of competitive challenge to the United States.

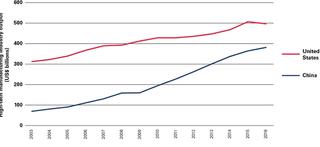

US concerns about losing technological leadership have been reinforced by an awareness of how rapidly Chinese capabilities are strengthening in overall research and innovation, and in leading-edge areas such as artificial intelligence.15 China’s R&D expenditure is now approaching the level of the United States, and the number of researchers in China now exceeds the number in America.16 The growth in science and engineering publications has been more rapid in China, which in 2016 produced more refereed science and engineering articles than the United States.

While the United States is the leading economy in terms of the percentage of GDP generated by KTI industries, China’s competitiveness in such industries is increasing rapidly. The output of China’s high-technology manufacturing industries now exceeds that of the European Union and, at 24 per cent of global output, is close to 80 per cent of the US level.17 China is the largest producer in the information and communications technology (ICT) subsector of high-technology manufacturing, where it has a 34 per cent global share.18

Chinese firms and investors have also recently increased their investment in US start-ups. One source estimates that Chinese direct investment into Silicon Valley tech firms exceeded US$6 billion by 2015, involving more than 140 individual deals.19

Figure 1: The steady rise of China’s high-tech manufacturing industry output, 2003-16

Evolution of the US innovation system in response to crises

The last time there was a similar level of concern about US innovation and the effectiveness of technology transfer was in the 1980s. At that time, the source of anxiety was the rapid improvement in Japanese technological and industrial capability. In fact, many of the elements of the US innovation system that are critical for its effectiveness were introduced during earlier periods of crisis (Table 1).

During the Second World War and through the early years of the Cold War, federal funding increased for a growing array of federal research laboratories pursuing technology development.20 These investments in technology development have shaped the directions of innovation in the overall economy. The shock in 1957 when the Russians were first to put a satellite (Sputnik) into orbit, and the rapid emergence of Japan at a time of growing trade deficits in the 1980s, both stimulated phases of major, pragmatic policy innovation.

The Defense Advanced Research Projects Agency (DARPA) statement of its mission to make pivotal investments in breakthrough technologies for national security refers to the commitment made in response to the launch of Sputnik that the United States would be the initiator and not the victim of strategic technological surprises.21

Since then, there has been an enduring focus on technology development for security and competitiveness and on public-private partnerships.22

Stimulated by these challenges, the US Government has been particularly active since the early 1980s in establishing policies and programs to improve the transfer and economic exploitation of the results of federally funded R&D (Table 1).

Table 1: US research and innovation policy responses to crises23

|

Challenge |

Innovation system initiatives, with an emphasis on technology development, collaboration and knowledge transfer focused programs |

|

World War II |

Major expansion of research in federal labs and of federal funding of R&D, driving innovation in, for example, civilian nuclear power, the computer, the transistor and the semiconductor. |

|

Cold War and the Sputnik surprise 1950s |

Creation of the National Science Foundation (NSF) in 1950. Creation of NASA in 1958. Creation of Defense Advanced Research Projects Agency (DARPA) in 1958. Passage of the National Defense Education Act to strengthen STEM education. Formation of ARPA’s Information Processing Techniques Office in 1962. |

|

Rising competition from Japan — in the auto and electronic market and also in the IT sector — and an increasing trade deficit 1980s |

Bayh-Dole Act (1980) permitted recipients of federal research funds to retain title to inventions and encouraged universities to license inventions to industry. Stevenson-Wydler Technology Innovation Act (1980) requires federal laboratories to collaborate with state and local governments, universities and private industry, and to transfer technology, and requires labs to establish capabilities to support technology transfer. Economic Recovery Tax Act establishes the R&D tax credit (1981). NSF begins to form Industry-University Research Centers (IURCs) as public-private partnerships to focus on concrete technological problems faced by industry. Small Business Innovation Development Act (1982). Small Business Innovation Research (SBIR) program (1982).[^24] Cooperative Research Act enables firms, universities and federal laboratories to collaborate in precompetitive R&D (1984). The NSF’s Program for Engineering Research Centers (1985) — university-based centres working on translating research outcomes into commercial technologies. Advanced Technology Program (ATP) — Department of Commerce (1988) provides a federal matching grant for private sector research efforts designed to commercialise promising new technologies. Omnibus Trade and Competitiveness Act (1988) also established the Manufacturing Technology Centers, which aimed to improve capability in SME manufacturers. Manufacturing Extension Program (1988) — universities and federal laboratories encouraged to assist firms, including start-ups, with technological problems, particularly with advanced technologies. Framework for the formation of Cooperative Research and Development Agreements (CRADAs) between federal laboratories and private firms (1986) — extended to all federal labs in 1989. Most of these initiatives were strengthened through the 1990s. During the 1980s there was also a debate over the merits of developing an industry strategy and establishing an agency, as in Japan, to manage such a strategy.[^25] |

Over time a network of high-level researchers and project leaders developed. This informal network throughout industry, federal labs and universities helped to identify promising new technological trajectories, focus resources on research and innovation “missions” and bottlenecks, facilitate technology transfer, and broker relationships between research groups and between firms. The private sector has been extensively involved in policies and programs related to research and innovation, at the federal and state level, from the design to the allocation and review stages.26

These initiatives contributed to developing a highly decentralised innovation system while allowing for a good deal of discretion in technological leadership at the organisation and program levels.27

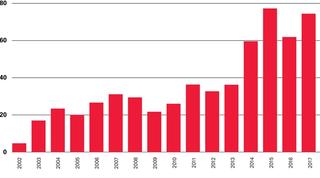

Hence, a review of technology transfer in 2018 under the Lab to Market and Return on Investment initiatives begins from a different point to these earlier reviews. The management of technology transfer has become increasingly professionalised, and most large research organisations have dozens of experienced staff in this role. A great deal has been learnt, and this accumulated experience is conveyed in many case studies and best practice guides. The level of venture capital available, one enabler of the formation and growth- and technology-based start-ups, far exceeds that of the 1980s (Figure 2).28

Figure 2: US venture capital investment US$ billion, 2002-2017

One important lesson concerns the channels and incentives for knowledge transfer. In the 1980s, and to some extent the 1990s, it was expected that technology transfer could be a major source of revenue for research organisations, that technology transfer offices (TTOs) should be profit centres and that legal officers should drive hard bargains around intellectual property. Thirty years later, few TTOs do more than cover their costs.

Technology transfer and enterprise development in the US innovation system

The extensive range of public-private partnerships existing in the US innovation system, from the research to the application stage of technology development, is encouraged by the active participation of the private sector in the research system and also by legislation such as the Bayh-Dole Act.

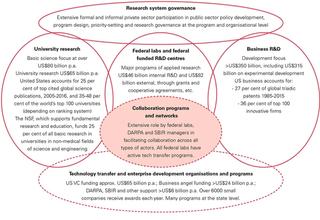

University funding, federal labs and R&D centres, and business R&D programs form the three pillars of innovation funding in the United States. A brief characterisation of the most important federal programs and arrangements and the roles they currently play in technology transfer, supporting enterprise development, steering technology development and facilitating the development of linkages, is set out in Figure 3.

Figure 3: The key role of US federal labs and programs in technology transfer and innovation

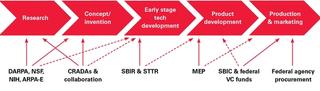

Public-private partnerships and procurement-related research support have shaped the development of the US innovation system. Innovation-oriented programs have contributed along the value creation chain, influencing supply and demand at each stage (Figure 4). There are many specific examples of the critical role of federal programs on US innovation and entrepreneurship.31 For example, it is widely recognised that DARPA’s role has been vital for the development of the US computer industry, as the role of the National Institutes of Health (NIH) has been in the development of US biotechnology. DARPA and the Office of Naval Research developed the global positioning system, which is now widely used throughout the economy.32

The National Science Foundation

In addition to the public-private partnership approach, over the past two decades the NSF has developed a wide range of complementary programs to support the transfer of technology.

While 75 per cent of NSF’s US$7.8 billion budget in FY2017 went to academic institutions, $240 million funded the Division of Industrial Innovation and Partnerships. Most of this (US$190 million per year) is directed to the Small Business Technology Transfer (STTR) and SBIR programs, which target start-ups and small businesses, to provide encouragement and support and reduce the risks of commercialisation.33

Figure 4: US federal public-private partnerships and innovation stages

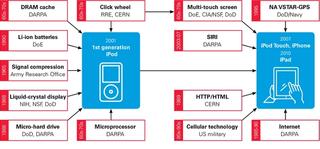

US public sector research has also been critical for many of the key technologies in the country’s IT sector beyond computing. The role of government funding in the development of the key technologies of the iPod and iPhone is one well-known example (Figure 5).34

Figure 5: Publicly funded technology in the iPod, iPad and iPhone

Table 2: Public-private R&D partnerships and technology transfer and business development support programs

|

Program |

What it does |

Why it is important |

Funding |

|

National Science Foundation University Cooperative Research Centers |

|

|

US$240 million in FY2017 |

|

Cooperative R&D agreements (CRADAs) |

|

|

All participants meet their own costs |

|

Materials Genome Initiative (MGI) |

|

|

US$40 million p.a. (est.) |

|

National Nanotechnology Initiative (NNI) |

|

|

Funds largely from federal labs |

|

National Robotics Initiative (NRI) |

|

|

Funds largely from federal labs |

|

Defense Advanced Research Projects Agency (DARPA) |

|

|

US$3 billion in FY2017 |

|

Advanced Research Projects Agency-Energy (ARPA-E) |

|

|

US$306 million in FY2017 |

|

Small Business Innovation Research (SBIR) |

|

|

US$2.5 billion in FY2015 |

|

Small Business Technology Transfer (STTR) program |

|

|

|

|

Other collaborative R&D relationships with federal labs |

|

|

|

|

Manufacturing USA |

|

|

US$300 million p.a. (est.) |

|

Manufacturing Extension Partnership (MEP) National Network |

|

|

US$140 million p.a. |

|

Small Business Investment Company (SBIC) |

|

|

US$4 billion in VC investment |

|

Federal agency venture capital funds |

|

|

|

The contrasts with Australia

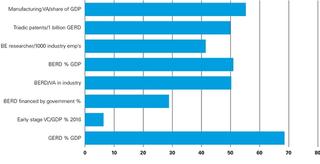

Australia’s overall innovation-related performance is significantly lower than that of the United States. As shown in Figure 6, the overall intensity of investment in research (GERD/GDP) in Australia is at just under 70 per cent of the US level. Manufacturing, particularly “high-tech” manufacturing, plays a smaller role in the Australian innovation system, and this is one reason why the research intensity of industry (BERD/GDP or VA) is only about 50 per cent of the US level. Universities in Australia play a much larger role, accounting for 31 per cent of GERD, compared with 13 per cent in the United States, whereas federal labs play a larger role in the US innovation system. The major components of the Australian innovation system are shown in Figure 7.

Figure 6: Research and innovation indicators: Australian level as a percentage of the US level (2015)

Figure 7: Collaboration in the Australian innovation system

However, several other points need to be taken into account in any assessment of the relevance to Australia of the US approach to innovation and commercialisation policy.

Industry, research organisations and policy in Australia evolved differently than in the United States

Australia’s manufacturing industry developed behind high levels of natural and tariff protection. Consequently, Australia has very few large innovation-based and export-active firms — this is also one reason why a high proportion of BERD in Australia is in service sector firms. Australian industry is characterised by high levels of concentration in many sectors,39 a relatively high proportion of employment in SMEs, three times the OECD average proportion of “low and medium technology industries” and a relatively large role for foreign affiliates.

Australian firms also have limited experience in innovation-based competition in global markets. It is estimated that only 16 per cent of Australian businesses have a high-performance innovation culture, in contrast to 44 per cent of the Global Innovation 1000.40 Moreover, 36 per cent of Australian businesses had a “siloed” innovation culture, and 39 per cent had little or no innovation culture. This is consistent with the World Economic Forum ranking of Australian business “sophistication”, which at 28th is behind most OECD countries, based on assessments of cluster development, local supplier quality, value chain breadth and international links (Table 3).41

Table 3: World Economic Forum Global Competitiveness Index 2017-2018 — Business Sophistication42

|

|

Australia rank (out of 137 countries) |

Australia score (out of 7) |

United States rank (out of 137 countries) |

United States score (out of 7) |

|

Business sophistication |

28 |

4.9 |

2 |

5.8 |

|

Local supplier quantity |

79 |

4.4 |

3 |

5.7 |

|

Local supplier quality |

22 |

5.3 |

6 |

5.8 |

|

State of cluster development |

51 |

4.0 |

1 |

5.7 |

|

Nature of competitive advantage |

24 |

4.7 |

15 |

5.7 |

|

Value chain breadth |

48 |

4.2 |

4 |

5.7 |

|

Control of international distribution |

27 |

4.5 |

1 |

5.7 |

|

Production process sophistication |

26 |

5.2 |

9 |

5.9 |

|

Extent of marketing |

19 |

5.2 |

1 |

6.0 |

|

Willingness to delegate authority |

9 |

5.7 |

8 |

5.7 |

Surprisingly, given the long concern about the lack of innovation in Australian industry, the proportion of innovating firms in Australia that receive government funding for innovation is remarkably low — the lowest in the OECD for large firms and the second lowest for SMEs.43

Australia has a research system that produces high-quality research — but mostly in organisations weakly connected to industry and hence to innovation

Australia has a reasonably high intensity of research output based on several indicators of the number and quality of research publications.44 Since 1995 Australian researchers have steadily and markedly increased their average citation impact and share of world publications. Australian research publications comprise more than 7 per cent of the world’s top 1 per cent most highly-cited publications across all disciplines.45 However, while research publication performance has been high in environmental sciences, agricultural and veterinary sciences, biological sciences, biomedical and clinical health sciences, and engineering,46 the level of citations for Australian STEM publications is lower than for almost all OECD country comparators.47

The weak linkages between research organisations and industry contribute to and are reinforced by the lack of mobility of professionals among industry, research and government.

The key innovation dynamic in Australia is technology absorption and adaptation for domestic markets. Australia is, in general, an innovation follower rather than a leader

Adoption of innovations developed by others is the most common type of innovation in Australian business.48 Most innovation is incremental, requiring modest inputs of time, capability and investment.49 The total proportion of innovation-active businesses in Australia earning a quarter or more of their income from innovative goods and services was 21 per cent for micro-sized businesses, but only 3 per cent for large businesses.50 Australia has a relatively low proportion of R&D-active businesses introducing product or process innovations, ranking last on this measure relative to 28 OECD countries.51 Australia has less “new to market international innovators”, as a proportion of innovating firms, than almost all other OECD countries — most firms are “domestic modifiers”.52 Australia ranks 20th out of 23 countries in the OECD in the proportion of income (7.2 per cent) from new or significantly improved goods and services, and only 5.5 per cent of surveyed businesses reported delivering new to market goods and services in 2014-15.53 Many Australian businesses are process innovators, pursuing innovation to reduce costs or improve efficiency rather than producing new products that might, for example, open export markets.54

Table 4: Type of innovation introduced by Australia’s innovating businesses, 2014/1555

|

Type of innovation |

Products (%) |

Processes (%) |

Organisational (%) |

Marketing (%) |

|

New to the world |

8.4 |

2.5 |

2.2 |

1.2 |

|

New to Australia but not the world |

7.4 |

3.9 |

3.1 |

1.8 |

|

New to the industry |

12.9 |

9.4 |

5.9 |

5.9 |

|

New to the business only |

74.5 |

85.8 |

90.5 |

92.2 |

Rates of product innovation in large firms in Australia are very low relative to comparable countries,56 while rates in smaller firms (less than 250 employees) are similar to those in comparable countries.57 Very few Australian firms focus on introducing new to the world products;58 many of Australia’s largest firms are in domestically-focused oligopolistic markets, and few compete in international markets.

Australia is not a significant player at the international technology frontier, and the “innovation system” has a low capacity for generating new areas of international specialisation

Consistent with its orientation to technology adaptation, Australia is not a strong innovator at the global frontier, apart from in some small niches at some times. This is clear from several indicators:

- Australia is in the middle of the OECD range for triadic59 patent families per million population (18th of 37), but the level is only 14 per cent of the level of the five top performers. (The picture is similar for patent applications under the Patent Convention Treaty.)60

- Australia is not a top-tier player in major emerging technologies or disruptive technologies, except for quantum computing.61

- There is a low level of international technological engagement, as shown by indicators of global connectedness: trade, exports of goods, exports of services, and technology balance of payments as a proportion of GDP [which suggests an increasing dependence]. There is a low (but rising) proportion of patents with foreign co-inventors, and low participation in global value chains. For example, trade as a proportion of GDP ranks Australia 33rd of 35 in the OECD.

As most Australian businesses are focused on the domestic market and few are based on competition at the global frontier, the business sector has generally not been a strong advocate for a stronger government role in innovation. Australia has not generated new areas of international specialisation, particularly not new knowledge-intensive, internationally competitive industries. This is despite a strong focus on start-ups, new business creation and technology commercialisation.

Overall levels of research-business collaboration for innovation are low

In most OECD countries, collaboration between research organisations and industry is generally concentrated in a small number of research-intensive sectors, and particularly in larger firms facing competition based on international technology.63

Australian industry’s collaboration with higher education and research institutions ranked the lowest of 27 countries in the OECD, both for large businesses and for SMEs — less than 10 per cent of the level of leading performers.64 Only 6.2 per cent of large, innovating firms in Australia collaborate with universities, while in Germany 40 per cent do and in Finland 69 per cent.

In 2013/14, only 2.3 per cent of business sector expenditure on R&D was directed to higher education organisations and 1 per cent to government research organisations. In 2014-15, only 3 per cent of Australian businesses reported sourcing their ideas for innovation from higher education institutions, indicating that Australian businesses are largely disconnected from the publicly funded research sector.65

Additionally, Australian businesses are not collaborating within their supply chains. Innovation-active Australian businesses rank 25th of 30 OECD countries for innovation-related collaboration with suppliers, and 20th of 30 for collaboration with customers. The rankings are even worse for large businesses.66

In Australia, the proportion of innovation-active SMEs that collaborate with universities or public sector organisations for innovation is 4.1 per cent — a third of the OECD average and the second lowest in the OECD

As most Australian firms that are innovation and R&D-intensive are SMEs, and hence have limited resources, the challenge for research-industry collaboration is to devise innovative policy that will be effective in the Australian context. Currently, the proportion of innovation-active SMEs that collaborate with universities or public sector organisations for innovation is 4.1 per cent — a third of the OECD average and the second lowest in the OECD.

While there have been many examples of successful research-industry collaboration in Australia, particularly in mining, agriculture and medical devices, the overall picture is of a poorly linked innovation system. Policies to increase business research collaboration have had little effect on overall levels of collaboration. As emphasised, the characteristics and challenges of research-industry collaboration need to be understood within the context of the structure of the economy: the relatively small and declining manufacturing sector, the relatively large role of low- to medium-technology industries, the small number of large research-intensive firms, relatively large services and resources sectors, and the relatively high proportion of SMEs.

For research organisations, technology transfer to technology-based start-ups and spin-outs is an alternative to licensing to established firms. However, early stage venture financing in Australia (as a proportion of GDP) is less than 10 per cent of the US level.67 The average ratio of income from “licences, options and agreements” to research expenditure for Australian universities and public sector research organisations is 1.8 per cent, compared with 3.8 per cent in US universities. The higher levels of venture capital available in the US, the greater strength of many entrepreneurial ecosystems, and the substantial role of the SBIR and other government programs supporting new technology-based ventures, enable these ventures to play a larger role in commercialisation.68

These comparisons suggest that the propensity for public-private partnerships is much higher in the US than Australia. Australian universities and public sector research organisations generate patents at 20 per cent of the rate of US universities per R&D dollar, and start-ups at 25-30 per cent. The US innovation system is far more dynamic than Australia’s, and effective commercialisation in Australia presents particular challenges. In view of the lack of improvement in research-industry collaboration, these are challenges that are not being met.

Australia shows conceptual lock-in and limited policy learning

An outline of the evolution of Australian innovation policy is given in Table 5. While there have been several important organisational developments over the past 30 years, the context for innovation and commercialisation policy has been characterised by:

- Policy approaches that are framed by an emphasis on market-based measures such as the R&D tax concession; largely technology-neutral support, due to the belief that government should not pick winners; and a focus on the linear model of innovation. Government support for business innovation is overwhelmingly focused on the R&D tax concession, to the extent that almost all Australian government support for business R&D is through indirect measures. In almost all OECD countries, direct R&D funding forms a larger proportion of the support for business R&D. In Australia, direct funding accounts for only 12 per cent of support, whereas in the United States it accounts for more than 70 per cent.

- Stop-start industry and innovation policy that undermines continuity. The government department responsible for industry has changed its name and functions 18 times since 1960. Continuous change in the machinery of government has led to a short-term approach and much policy instability. An analysis of “program stability” indicates there have been a total of more than 350 expenditure programs over the period 2005/06 to 2016/17, and that programs operated for an average of 4.23 years.69 There have been 10 changes to the incentive level or structure of the R&D tax concession (currently known as the R&D tax incentive) since 1989.70

- Many reviews and studies addressing innovation policy challenges, but little evidence of these building on prior studies and evaluations, and hence of policy learning. The evolution of policy has generally been conservative, adding or extending organisations and programs, while reorganisations and redirections have been cautious.

- In contrast with many other countries, an unwillingness to create independent organisations with substantial degrees of freedom to develop innovation and commercialisation programs, select priorities and fund initiatives that build capability in industry and stimulate the development of new innovation and industrial strengths.

- Little interest in harnessing the demand side to drive innovation through procurement and regulation, despite the key role that procurement-related innovation programs have had in the United States and other countries.71

Table 5: The evolution of Australian innovation policy programs

|

Policies and programs between 1983 and 1996 This period saw progressive reductions in tariff protection, the introduction of measures to support adjustment while building new capabilities, and the development of a stronger, more strategic and forward-looking role for government in industry and innovation policy. There was a strong focus on structural issues. |

|

|

Business innovation |

A series of initiatives with the objectives of raising competitiveness through innovation and skill development and increasing international orientation through exporting and foreign investment:

|

|

Research system |

Increasing support for university research funding |

|

Commercialisation and research-industry links |

Initiatives to stimulate collaboration among research organisations and with industry:

|

|

New enterprise development |

Introduction of incentives for the formation of venture capital funds:

|

|

Sectoral and thematic programs |

A focus on programs to support adjustment and capability development in sectors facing increasing import competition due to progressive tariff reductions:

|

|

Policies and programs after 1996 This period has seen several changes of government, and the introduction and cessation of many specific innovation and commercialisation programs, largely within the framework that had been established. However, more recently the focus on exports of commodities and imports of capital and immigrants has reduced the emphasis on endogenous drivers and capability. |

|

|

Business innovation |

|

|

Research system |

Increasing support for research:

|

|

Commercialisation and research-industry links |

Governments introduce (and replace) initiatives to encourage closer research-industry collaboration:

|

|

New enterprise development |

Further initiatives to encourage venture capital development. |

|

Industry and thematic programs |

Programs to support adjustment in the automotive, textile, clothing and footwear and steel industries continue. Centres of Excellence and development strategies in generic technologies: information technology, biotechnology and nanotechnology. |

Can we learn from the characteristics that contribute to the effectiveness of the US approach?

The United States has an innovation system with great strengths in the supply of knowledge — from world-leading research universities, federal labs and research-intensive companies — and can apply new knowledge to innovation. It is the origin of a third of the world’s most innovative companies and over half of global venture capital.

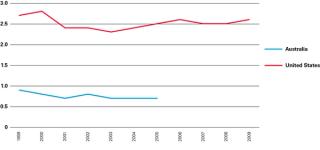

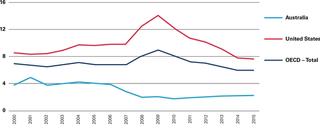

The US Government, through a range of programs, plays a much more pragmatic and proactive role than Australian governments in supporting innovation and entrepreneurship. Figure 8 shows the proportion of business R&D (BERD) financed by government is three times higher in the United States than in Australia.

The US Government, through a range of programs, plays a much more pragmatic and proactive role than Australian governments in supporting innovation and entrepreneurship.

The effectiveness of the government role in the US innovation system comes not only from the range of major programs and the levels of funding involved, but also from the approach taken to support and engagement, which is characterised by:

- A pragmatic approach to policy design and ongoing adaptation, with a focus on achieving national innovation goals.

- A strong focus on innovation objectives at the program level, often based on defined “missions” to develop advanced technologies and address bottlenecks that limit industry-wide performance. This approach facilitates a continuous negotiation between top-down and bottom-up innovation priorities within a context of strong accountability.

- A high level of ambition, along with preparedness to support high-risk projects and withdraw support from those that are not performing.

- Recruitment of people with high-level technological expertise on short-term contracts to manage programs like DARPA and SBIR, adding a constant supply of energy and contacts, and active linkages in the innovation system.72

- Flexible approaches to funding to achieve outcomes, including preparedness to operate like a venture capital investor, identifying gaps in capability and funding to fill those gaps, including in production facilities.

- A strong concern with building capability in firms and research organisations to enable continuing performance beyond the project time frame.

- A particular focus on supporting the formation and growth of SMEs.

Figure 8: Percentage of BERD financed by government (Australia and the United States), 2000-2015

Conclusion

A low level of research-industry collaboration has been a perennial problem for Australian innovation policy. Despite a diverse range of programs74 and many specific successful collaborations, little has changed at the overall national level. A recent review concluded:

[there are] a number of reasons for these problems, including the absence of effective institutions, relationships and incentives … measures to support the translation of public sector research in Australia are fragmented, uncoordinated and under-resourced.75

Bold and pragmatic policy experiments designed to address the specific challenges of the Australian innovation system have also been missing.

Most of the US programs discussed above were introduced in response to challenges when there was a sense of urgency, but were in many cases modified over time in response to their contexts. They have contributed significantly to shaping the dynamic US innovation and entrepreneurship systems. This policy experience shows that:

- Governments can play a major and effective role in facilitating knowledge transfer and value creation from university and public-sector research. A coordinating role is increasingly important as innovation has become more collective and interactive, and more dependent on a supporting knowledge infrastructure. In the case of emerging technologies and industries, government needs to step in when markets are not effective institutions for supporting entrepreneurship and innovation.

- Governments can effectively develop approaches, drawing on relevant expertise, that identify research priorities and guide the direction of innovative effort at the level of the innovation system. Missions and other well-funded collaborative programs with specific innovation objectives can provide powerful focusing devices if the level of funding is enough to make a difference.76

- Design and management of government policies and programs to support innovation needs to be pragmatic and to respond to evaluations and new challenges. The analysis of international experience and a good understanding of national challenges are better guides to innovation policy than the very limited innovation frameworks based on economic theory.

A low level of research-industry collaboration has been a perennial problem in Australian innovation policy. Despite a diverse range of programs and many specific successful collaborations, little has changed at the overall national level.

In the 1950s, 70s and 80s, when many aspects of US innovation policy were developed, the United States faced what were perceived to be systemic challenges to its technology leadership. These challenges led to major, pragmatic and highly effective policy innovations. It remains to be seen how the responses to the “Chinese challenge” will be shaped by the different technological, trade and political context today.

At the April Symposium launching the Lab to Market initiative, Deborah Wince-Smith, president and CEO of the Council on Competitiveness, suggested that deeper policy and ecosystem changes will be necessary to respond to the challenges. She suggested that new approaches to application-driven basic research, venture capital and collaboration will be needed, which engage earlier, take on more risk over a longer time horizon and sustain engagement through to application.77 This means a stronger role for government and longer-term planning for strategy and investment — perhaps a bit more like that in China. This is a policy debate that is just beginning in the United States.

Debates about effective innovation and entrepreneurship policy have not yet attracted similar levels of interest or urgency in Australia.

Recommendations

While developing new areas of specialisation takes time, the indicators do not suggest that Australia’s innovation policies are becoming effective. Innovation performance has improved little over time.78 In particular, research-industry collaboration has declined in recent years.79 Policy, over recent decades, has built an impressive research system, but not an innovation system.

Innovation capability is increasingly critical for sustaining competitiveness and for developing new trajectories and options for economic growth, creating new sources of comparative advantage. Building a robust innovation system and ensuring an increasing range of options for our economy is now a key responsibility of government. However, policy innovation in Australia has been crippled by a lack of ambition and an excess of theory. Bold and significant change in Australia’s innovation policy framework is required.

The following four initiatives are proposed to energise and strengthen the fragmented Australian innovation system.

- Recognise that the R&D tax incentive cannot be the central mechanism of innovation policy.

The R&D tax incentive may be theoretically sound, but it is practically useless. In an industrial system where the majority of business R&D is incremental and focused on adaptation of technology, a market-based incentive will do little to change behaviour, generate high levels of additionality and develop new areas of specialisation.80 Yet, Australia is an outlier in the OECD in its dependence on the R&D tax concession. Only one other country makes more use of such indirect incentives, as most rely on direct funding to a much greater degree. In the United States, for example, where the level of government funding for BERD is twice that of Australia, more than 70 per cent of that support is provided through direct funding mechanisms.

Due to Australia’s lack of strong innovation leaders in industry and the weakness of market mechanisms in leading, stimulating and supporting innovation in times of technological and market disruption, government must play a stronger role in innovation. An effective government role would emphasise programs that focus on ambitious innovation outcomes, and redevelop programs based on direct funding to the private sector. - Develop ambitious national missions, rather than vague and inclusive “priorities”, to focus investments in innovation and capability-building.

As recognised in the Innovation and Science Australia recommendations, many countries have effectively used goal-driven national innovation programs to build competence and collaboration.81 The approach to identifying the goals for such missions and managing projects is critical for effectiveness. The mantra that “governments cannot pick winners” is based on an ignorance of the history of industry and innovation and more specifically an ignorance of how mission- and innovation-oriented programs (rather than research-oriented ones) have been developed in other countries. Funding for national missions should come from funds redirected from the R&D tax incentive, including recent savings due to changes to the incentive structure, and from new funding. - Develop Innovation and Science Australia (ISA) as an innovation agency.

ISA could be commissioned as an independent agency to develop, fund and manage national innovation missions based on foresight, road-mapping and extensive consultation. If ISA were to have this role, its board and staff would need to be substantially strengthened, bringing in more experience with innovation management in diverse industries and areas of technology. Within clearly established objectives and accountabilities, program managers within ISA should have substantial discretion around funding decisions and performance assessment. Developing effective public-private partnerships would be a particularly important aspect of the agency’s work. - A proportion of government funding for R&D, rising over 10 years to 10 per cent, should be allocated to SMEs (firms with less than 250 employees, including start-ups) with clearly defined innovation objectives and capabilities.

To develop new innovative firms and leaders, an increasing proportion of the R&D funds currently going to universities and the CSIRO, along with additional funds, should be redirected to build innovation capabilities and performance in the private sector. Much of this support should be within the framework of the national “innovation missions”. Recognising that these will be high-risk investments, funding support should be staged, with tranches based on performance and firms supported by active program managers working with them to address problems.

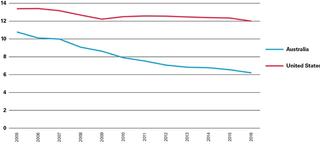

Appendix: Australian and US manufacturing

Figure 9. Manufacturing, % of value added, 2005-2016

Figure 10. High-technology manufactures, % of value added, 1999-2009