Real-time measures of the US economy continue to point an unfolding downturn with a magnitude, if not duration, as severe as the Great Depression.

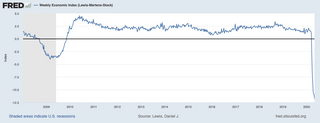

Daniel J. Lewis, Karel Mertens, and Jim Stock have developed a weekly economy index (WEI) with a view to tracking the downturn in close to real-time. The WEI is an index of real economic activity using timely high-frequency data. It represents the common component of ten different daily and weekly data series covering consumer behaviour, the labour market, and production.

The WEI has the advantage that it is scaled to the four-quarter GDP growth rate, so it can be interpreted in terms of the more familiar measure of activity. The most recent reading for 2 May of -11.8 per cent, if maintained over the quarter, would imply a decline in GDP of around 12 per cent in the current quarter compared to the same quarter the previous year. This is similar to the way in which Australia reports its annual rate of economic growth.

US initial unemployment insurance claims for the weak of 2 May are released on Thursday, with economists expecting another 3 million claims to be filed. This would bring the number of initial unemployment claims since the first week in March to over 33 million. As noted in this space previously, as many as 48 million jobs could be at risk from pandemic suppression measures, which would see the unemployment rate rise above its Great Depression peak of 25 per cent in 1933.

US non-farm payrolls for the month of April are released Friday and are expected to show a loss of more than 20 million jobs and a jump in the unemployment rate from 4.4 per cent to nearly 17 per cent.

US non-farm payrolls for the month of April are released Friday and are expected to show a loss of more than 20 million jobs and a jump in the unemployment rate from 4.4 per cent to nearly 17 per cent. However, it is likely the survey will under-estimate the increase in the unemployment rate. There are significant conceptual differences between unemployment as measured by initial claims and as measured by the payrolls survey. It is possible to receive unemployment insurance and not be counted as unemployed by the payrolls survey.

The headline U3 definition of unemployment also requires a person to be actively looking for work to be counted as unemployed. Many potential workers will be precluded from searching for jobs due to suppression measures and so will be counted as not in the labour force. This will be better captured in measures of underemployment rather than unemployment, such as the U6 measure, which already shows an underemployment rate of 8.7 per cent.

The payrolls survey also suffers from a well-known bias to underestimate employment during expansions and over-estimate it during contractions, an artefact of the model of business formation underlying the survey. So, while the April numbers will be shocking enough, they will likely understate the extent of the carnage in the US labour market.

Meanwhile, a growing body of research is examining the long-run economic effects of pandemics, which can persist for up to 40 years. Pandemics also have highly persistent political implications. For example, the incidence of Spanish flu in Germany helps predict voting for the Nazi party more than a decade later, controlling for a wide range of other factors.

Long after the US economy has seemingly recovered from COVID-19, the economic and political system will be carrying the scars.