The United States and Australia enjoy a deep and multi-faceted relationship spanning many years and generations. Having fought in every major war together for the past century and bound by a formal military alliance since 1951, much attention has focused on the security relationship between the United States and Australia. But there is also a major economic story in the US-Australia relationship that often goes overlooked.

There are obvious differences when comparing the United States to Australia — the United States has 13 times the population of Australia and is the world’s largest economy, while Australia is the world’s 14th largest.

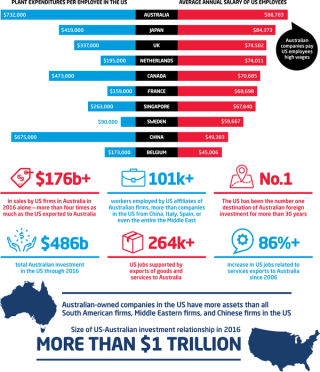

In 2016 alone, exports to Australia generated 264,000 US jobs and in more than 15 states Australia ranks among the top 10 export destinations.

Yet a look at the data on the deep and historic economic ties between these two nations make clear that Australia has a disproportionately large trade and investment relationship with the United States, making the United States Australia’s most important economic partner.

With a population of just 24 million, Australia welcomes more American exports than almost anywhere in the world. The Australia-US Free Trade Agreement has seen US goods exports to Australia increase 76 per cent since it went into effect in 2005 and US services exports more than double in the same period. In 2016 alone, exports to Australia generated 264,000 US jobs1 and in more than 15 states Australia ranks among the top 10 export destinations.2 Australia was the single largest export market for Hawaii, having received nearly 40 per cent of all Hawaiian exports in 2016.3 Australia was also the second largest export market to Maryland and the fifth largest export market for Illinois in 2016.4

Trade is just one part of the story. Investment between Australia and the United States is also a powerful driver of economic growth in both countries. The United States has been the largest source of foreign investment into Australia for more than 30 years; Australia has received more US direct investment than China, Japan, Mexico or even all of Africa and the Middle East combined. At the same time, the United States has also been the largest destination of Australian foreign investment for many decades.

The United States has been the largest source of foreign investment into Australia for more than 30 years; Australia has received more US direct investment than China, Japan, Mexico or even all of Africa and the Middle East combined.

There are estimated to be more than 3,000 points of presence for Australian business entities across all 50 states, with more than 140 Australian companies earning or valued at $20 million or more, 47 of which have 250 employees or more.5 The average salary across the 101,000 employees at Australian companies in the United States is more than $88,000 a year, which is nearly $10,000 more than the average salary paid by European affiliated companies in the United States and $40,000 more than the average US income.6

This is an impressive economic footprint into the world’s largest economy — just one of the many ways Australia and Australians punch above their weight in the United States.

None of this is an accident. There are lots of destinations for capital in a globalised economy. Like Australia, the United States is a liberal democracy, committed to the rule of law, secure property rights, limits to state power and procedural fairness. Growing populations, dynamic cities separated by vast distances and abundant natural resources add to the similarities and opportunities. In the United States, Australian businesses and investors see a country that mirrors their own.

As in the United States, our forebears made credible commitments to these institutions and successive generations have stuck by them. That’s why so much American capital goes to Australia, that’s why so much Australian capital goes to the United States, and why our countries both benefit from their deep economic relationship.

Australia’s oversized economic impact in the United States

Australian investment into the United States

The United States has been the single largest destination of Australian investment for many years.

More than 28 per cent of all outbound Australian investment comes to the United States, and is cumulatively valued at $486 billion — equivalent to more than one-third of Australia’s GDP in 2016 — more than seven times the $68 billion that Australia has invested in China. Major Australian firms, ranging from biotechnology giants like ResMed to shipbuilders like Austal, see the United States not just as one of its largest markets but as a springboard to the world.

Australian investment in the United States continues to grow significantly, doubling since 2005 and nearly tripling since 2001.

Figure 1: Australian-owned companies in the United States

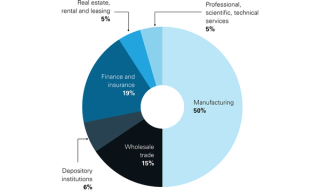

High-paying jobs are supported by Australian firms’ US operations. Per employee, Australian firms in the United States pay more than Japanese, British, French, or Swedish firms in the United States. There are other countries with a larger direct investment footprint in the United States than Australia’s, but in many cases Australian firms are outspending firms from these countries in expenditures for property, plant, and equipment (e.g., Ireland, Spain and Belgium).7

Figure 2: Types of Australian direct investment into the United States

The Perth-based Austal, for example, employs 4,000 workers in Alabama. Australian property giant Lendlease has helped implement new public private partnerships in the US real estate sector. The Sydney-based Brambles, one of the largest and oldest supply chain solution companies in the world, employs 3,000 workers across the United States. ResMed, a company that began marketing technology developed by a University of Sydney professor, has moved headquarters to San Diego and now leads the world with more than four million cloud-connected medical devices.

This is but a sampling. Few Australians — and even fewer Americans — know Australia has grown a titanic stock of capital in its superannuation funds (pension and retirements funds). In 2015, Australian superannuation funds were assessed as the third largest in the world, behind the United States and the United Kingdom, with investments valued at $1.5 trillion, equivalent to 120 per cent of Australian GDP.

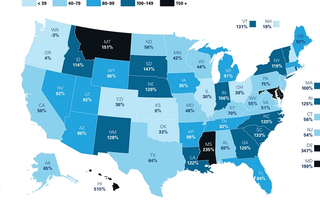

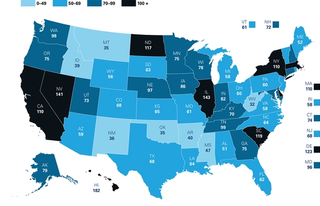

Figure 3: Employment directly supported by exports to Australia, per 100,000 residents

Massive amounts of this colossal investment pool comes to the United States as portfolio investment, the demand for diversification, yield and confidence pushing vast amounts of Australian capital into the United States. This investment helps grow American firms, build and repair US infrastructure, creating American jobs and securing economic prosperity for both countries.

Australian trade with the United States

The US-Australian economic relationship dates as far back as 1793, when the American trading ship Hope delivered 7,500 gallons of rum to Sydney.8

While bilateral trade and investment between the United States and Australia flourished from that date onward, the Australia-US Free Trade Agreement heralded a new era when it came into force in 2005, as US exports to Australia have more than doubled.9 More than a decade later, 96.1 per cent of all Australian exports are tariff-free.10

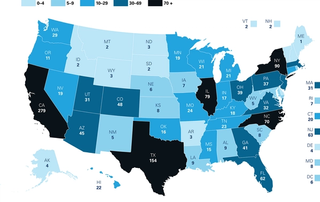

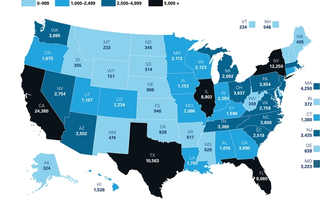

Figure 4: Employment directly supported by exports to Australia

In 2016, the United States remained Australia’s second largest trading partner in goods and services and the largest trading partner for services, exporting machinery, travel services, industrial supplies and materials, consumer goods, and financial services.11 Today, the US trading surplus with Australia is the fifth highest out of all of America’s bilateral trade relationships, only following Belgium, the Netherlands, UAE and Hong Kong — all of which are nations with favourable corporate tax structures.

The make up of what Australia imports from the United States is diverse, with the top four goods being passenger motor vehicles; aircraft, spacecraft and parts; medical instruments; and measuring and analysing instruments.

Table 1: Total exports to Australia

| Export market rank for Australia [1] | Total exports in 2016 (US$ million) [2] | Top goods export to Australia in 2016 [2] | |

|---|---|---|---|

| Hawaii | 1 | 449 | Transportation equipment |

| Maryland | 2 | 1,015 | Transportation equipment |

| North Dakota | 3 | 149 | Machinery |

| Illinois | 5 | 3,116 | Machinery |

| South Dakota | 5 | 79 | Computers and electronic products |

| Nebraska | 6 | 284 | Machinery |

| Iowa | 6 | 430 | Machinery |

| Wisconsin | 7 | 766 | Machinery |

| South Carolina | 7 | 997 | Transportation equipment |

| Arkansas | 8 | 119 | Transportation equipment |

| Wyoming | 9 | 54 | Chemicals |

| Kansas | 9 | 311 | Transportation equipment |

| Missouri | 9 | 569 | Transportation equipment |

| Alaska | 9 | 433 | Minerals and ores |

| Indiana | 10 | 984 | Transportation equipment |

| Alabama | 10 | 433 | Transportation equipment |

This surge in exports to Australia has supported a commensurate rise in jobs related to exports to Australia, with jobs supported by US exports to Australia increasing by 37 per cent since 2006 and services exports jobs alone increasing by 86 per cent in the same period. In 2016, a total of 264,000 US jobs were either directly or indirectly supported by state exports to Australia, an increase of around 72,000 from 2006.

On a proportional level, the employment impact is highest in Hawaii, Illinois, and Nevada, where they have, respectively, approximately 182, 143, and 141 jobs per 100,000 residents from exports to Australia.

Figure 5: Total increase in exports to Australia since 2006