Economic policy uncertainty is at unprecedented levels due to the COVID-19 pandemic. In previous research, I highlighted the role of economic policy uncertainty in driving cross-border trade and investment, but also exchange rates and interest rates and domestic economic activity. Economic policy uncertainty helped explain the outsized impact of President Trump’s tariffs on business investment in Australia and the US.

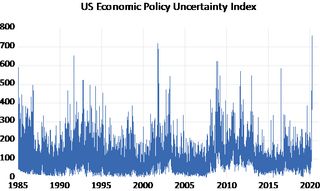

Economic policy uncertainty is now at record levels in the United States, exceeding the level seen during the 2008 global financial crisis, as shown in the daily measure complied by Baker, Bloom and Davis at policyuncertainty.com, based on textual analysis of US newspapers.

This uncertainty can be expected to weigh on economic activity, quite apart from measures taken to shut-down economic activity for the purposes of pandemic control.

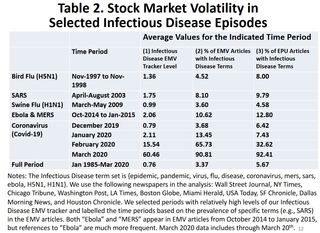

Baker, Bloom and Davis also produce an equity market volatility (EMV) tracker that combines newspaper mentions of terms related to the economy, equity markets and volatility. It tracks realised equity market volatility quite well. The EMV tracker has been extended to include terms related to the COVID-19 and other historical pandemics to identify the contribution they have made to stock market volatility.

The contribution of pandemic-related terms to both measures in various pandemic episodes are shown in the following table.

Both equity market volatility and economic policy uncertainty for February and March 2020 are being driven largely by the COVID-19 pandemic. By contrast, other pandemic episodes had a relatively small impact on the both market volatility and uncertainty. The authors conclude that “No previous infectious disease outbreak, including the Spanish Flu, has impacted the stock market as powerfully as the COVID-19 pandemic.”

Even if the more optimistic scenarios for containing COVID-19 are realised, the unprecedented nature of the policy responses to the pandemic is likely to leave an elevated level of policy uncertainty in its wake. This uncertainty will make a rapid recovery all the more difficult. While the initial policy response to the pandemic was bound to be somewhat ad hoc and unpredictable, an important task for policymakers going forward will be to restore policy predictability and certainty so that households and firms can plan effectively for the recovery.