Executive summary

AgTech — the wave of emerging technologies such as robotics, artificial intelligence, machine learning and biotechnology coming to food and agriculture — is increasingly creating opportunity for investors, entrepreneurs, farmers and consumers.

With the potential to both benefit Australia’s agricultural sector and create direct economic benefits through commercialisation of new technology, a strong AgTech specialisation would be of substantial benefit to Australia. A goal to lift AgTech’s share of venture capital (VC) in Australia from 1 per cent in 2018 to 20 per cent by 2030 would see AgTech take its place as a national priority and position Australia as a global leader.

With the potential to both benefit Australia’s agricultural sector and create direct economic benefits through commercialisation of new technology, a strong AgTech specialisation would be of substantial benefit to Australia.

Analysing the relationship between American start-up ecosystems and venture capital investment, and in particular looking at the impact that specialisation can have in building successful ecosystems, such as in St Louis, Missouri, offers insight as to how Australia can catalyse the development of the local sector.

Key observations about the distribution of AgTech start-ups and venture capital funding in the United States include:

- The large majority of AgTech start-ups in the United States are concentrated in California, New York and Massachusetts. This concentration follows the general concentration of venture capital in these states, in the extremely mature start-up ecosystems of Silicon Valley, New York and Boston. These ecosystems far outweigh Australia’s leading start-up ecosystems for scale and resources.

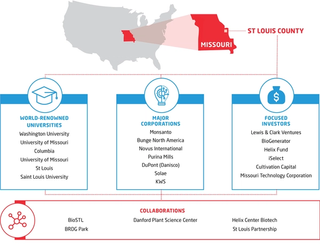

- Sub-sector specialisation can enable small ecosystems to outperform larger ecosystems by measure of start-ups created or investment dollars in those specialised sub-sectors. St Louis, Missouri has utilised endowments of strong research institutions, universities and large corporations to develop innovation infrastructure spanning government, academia, science, industry and investors, resulting in an AgTech specialisation. BioSTL, a not-for-profit coalition organisation, plays a pivotal role in the St Louis AgTech ecosystem.

St Louis, as an example of AgTech sub-sector specialisation, provides useful insights for Australia in driving specialisation in its start-up ecosystems, particularly in catalysing the growth of AgTech.

Recommendations

- Catalyse AgTech specialisation in Australia’s existing start-up ecosystems of Sydney and Melbourne by:

a. Creating AgTech districts to bring together researchers and corporations

b. Connecting urban ecosystems to on-the-ground expertise in regions - Empower lead organisations to identify and close AgTech gaps including:

a. Making AgTech a more attractive proposition for potential founders

b. Making a long-term commitment and getting the right measurements of success - Attract external capital and companies through a co-ordinated approach.

Australia’s AgTech opportunity

Agriculture is a core pillar of Australia’s economy. With a gross value of farm production of A$60 billion in 2017-2018,1 agriculture makes up 3 per cent of Australia’s GDP and around 14 per cent of exports.2 Further, Australia exports nearly two-thirds of its agricultural production.3

Even compared to much larger countries like the United States, Australia punches above its weight for agriculture. In the United States, though gross farm outputs are much higher (US$435 billion), farm production contributed only around 0.9 per cent of GDP4 in 2017 and the US exports only around 20 per cent5 of its agricultural production.

But in Australia and globally, agriculture is under pressure. Factors include falling prices in some key commodities, drought and climate variability, plateauing yields, and an estimated 2.5 billion more mouths to feed by 2050.

With these new stressors comes an opportunity. The commercial opportunity for technologies that improve the efficiency and productivity of agriculture is projected to be worth US$189 billion between 2013 and 2022, globally.6 The adoption of digital technologies holds the potential to drive significant increases in productivity and economic boosts for Australia, with recent estimates suggesting full uptake of digital agriculture could increase the gross annual value of agricultural production in Australia by 25 per cent.7

The commercial opportunity for technologies that improve the efficiency and productivity of agriculture is projected to be worth US$189 billion between 2013 and 2022, globally

The challenge and opportunity of bringing emerging technologies to agriculture has driven the development of a new sub-sector: AgTech. AgTech refers to the development and commercialisation of technologies along the agricultural value chain. AgTech encompasses not just digital software tools, but also hardware such as robotics, integrated systems like aquaculture and indoor farming systems, and plant and animal science, including animal genetics, plant breeding and biologicals.8

The emergence of the AgTech industry globally has been spurred on by the increasing accessibility and affordability of new technologies, such as off-the-shelf sensors, genome sequencing, satellite technologies, and affordable cloud-computing. However, for Australia to reach its commercial potential and remain competitive globally, development, application and adoption of this technology will be critical.

AgTech not only represents a significant opportunity for Australian agriculture, but is an emergent sub-industry in its own right, with the possibility of creating new businesses, new jobs and new economic and social value for regional and urban communities around Australia.

Given the United States’ strengths in both tech and AgTech, Australia can learn from its more mature ecosystems and the dynamics that characterise them. Doing so is critical for Australia: a strong and globally significant AgTech start-up ecosystem in Australia can help its agriculture industry remain globally competitive and achieve its goal of A$100 billion output by 2030.

Lessons from American tech and AgTech ecosystems

The United States is a powerhouse for start-ups, including in AgTech. There are three key lessons Australia can learn from American tech and AgTech ecosystems, and how they compare to the ecosystems in Australia.

Lesson 1: US AgTech investment is concentrated in just three states

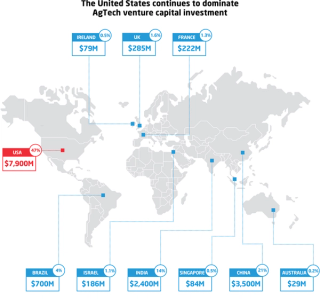

Globally, the United States is leading the way in AgTech. Figure 1 shows the extent of AgTech investment in the United States compared to other nations. Nearly 40 per cent of the companies worldwide that were successful in attracting investment in 2018 were American.9 These 567 companies attracted US$7.9 billion in investment, or close to half of the worldwide total investment into AgTech by dollar value.10

These investments represented a more than four-fold increase on the investment into US AgTech in 2016, highlighting the enormous growth in this sub-sector.11

A key characteristic of this investment is its geographic concentration. The vast majority of US agrifood tech investment is concentrated in just three states: California, Massachusetts and New York. California attracted US$5 billion in 2018, equivalent to 63 per cent of the US total,12 and 30 per cent of global AgTech investment. Massachusetts and New York captured 10 per cent and 7 per cent of US AgTech investment, respectively.13

These three states captured 80 per cent of US AgTech investment in 2018, and nearly 40 per cent of the global total.14 This lesson about AgTech applies to general tech as well, and is critical for Australia to appreciate given the differences in size.

|

Venture capital is a leading indicator of innovation and job creation Venture-backed firms are responsible for a disproportionate number of patents (a proxy for innovation) and new technologies, and they bring more radical innovations to the market faster than lower-growth businesses that rely on other types of funding, research shows. VC investments speed the development of companies, enabling them to rapidly transform ideas into market-ready products and become industry leaders through first-mover advantages. VC funding also increases the number of firms launched. An increase in the supply of VC positively affects firm launches. Nascent entrepreneurs establish new entities only if they perceive that the odds for obtaining funding are favourable. Evidence from 20 industries in the United States suggests that VC is three to four times more effective than corporate research and development at fostering innovation. Source: The Venture Capital Effect, AVCAL 2017 |

Figure 1: The US AgTech investment market: comparing the United States to global markets

Lesson 2: US tech start-ups are concentrated in just three cities

The dominance of these three states in venture capital funding is not a phenomenon unique to AgTech. This concentration of capital is longstanding and occurs broadly across tech investing.

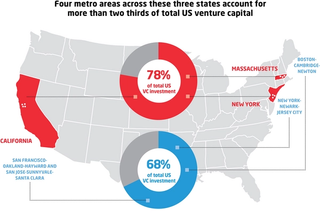

Of the more than 9000 venture deals completed in the United States across all industries in 2018, more than half occurred in California, New York or Massachusetts.15 Companies headquartered in these three states received 78 per cent of total US venture capital investment in 2018.16

The concentration of capital occurs at an even more granular level within these states. Companies headquartered in the metropolitan statistical areas (MSAs) of San Francisco-Oakland-Hayward and San Jose-Sunnyvale-Santa Clara, together commonly known as Silicon Valley, attracted more than US$65 billion in venture capital in 2018,17 capturing more than 80 per cent of venture capital investment into California, and 49 per cent of total US venture capital investment.18

In New York and Massachusetts, this metro-level concentration is even more pronounced. Companies headquartered in the New York-Newark-Jersey City and Boston-Cambridge-Newton MSAs received US$14 billion and US$11.6 billion respectively in 2018, representing 98 per cent and 99 per cent of investment into those states (see Figure 2).19

In total, just these four metro areas together captured US$90 billion in venture investment in 2018, more than 68 per cent of total US venture capital investment.20

Figure 2: US venture capital is highly concentrated: California, New York and Massachusetts companies receive more than three quarters of total US venture capital invested

Venture investment is a sign of mature start-up ecosystems

These four metro areas — San Francisco, San Jose, New York and Boston — where venture capital is concentrated, are ranked consistently in the world’s top five start-up ecosystems by Startup Genome, an American research organisation focused on analysing and catalysing start-up ecosystems.21

The rankings reflect the success of current companies, as well as the availability of key resources that are known to contribute to the future success of companies. These resources, or ‘success factors’, include access to funding, experienced talent, market reach and start-up-specific expertise.

|

Startup Genome’s definition and methodology Since 2012, global research organisation Startup Genome has published rankings of the world’s top start-up ecosystems. Startup Genome defines start-up ecosystems as shared pools of resources, similar to clusters, within a 100 kilometre radius. Using data from Crunchbase, the leading database on venture investment, thousands of qualitative interviews and machine learning algorithms, the Global Startup Ecosystem Rankings evaluate ecosystems on their relative performance using metrics like number of companies, ecosystem value, rounds of funding and exits. More information is available at https://startupgenome.com/[^22] |

Silicon Valley — the combined region of the San Francisco and San Jose MSAs — is the world’s top start-up ecosystem, followed by New York. Boston is ranked fifth.23

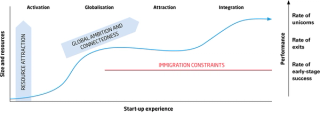

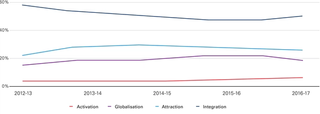

Startup Genome also categorises the start-up ecosystems by maturity (see Figure 3). More mature ecosystems have larger numbers of start-ups, large funding rounds and exits. Silicon Valley, New York and Boston are all categorised in the final stage of maturity, the “integration” phase. Ecosystems in the integration phase are characterised by large ecosystem values (>US$50 billion), more than 3,000 start-ups, large exits and numbers of unicorns.2425

Figure 3: Startup Genome’s Ecosystem Lifecycle Model

How do Australia’s start-up ecosystems compare?

Australia has two start-up ecosystems recorded by Startup Genome. Sydney is ranked 23rd in the world and Melbourne, though currently outside the top 30, has risen rapidly year-on-year and has been identified as an up-and-coming “challenger” ecosystem.27

Sydney and Melbourne, however, are start-up ecosystems at an earlier stage of maturity compared with the US leaders. Sydney and Melbourne’s ecosystems are categorised in the second phase of maturity, known as globalisation. Relative to later stage ecosystems, ecosystems in the globalisation phase have a significantly smaller ecosystem value, lower numbers of start-ups, and fewer large funding rounds, exits and scale-up creation (see Figure 4).28

Figure 4: Share of start-up exits above US$50 million by start-up ecosystem lifecycle phase

The maturity difference between Australia’s leading start-up ecosystems and America’s is material and magnitudinal. In 2018, all start-ups across Australia collectively attracted US$1.5 billion in venture investment.30 This national total is nearly 10 times less than the US$14 billion of venture investments in New York MSA in 2018, and more than 40 times less than the US$65 billion invested in Silicon Valley.31

With this stark contrast in size, even the most ambitious of Australian start-up ecosystem developers cannot aspire to imitate Silicon Valley or New York. Where then can Australia look for insights and aspirations to catalyse Australia’s success in the subsector of AgTech?

Lesson 3: Outside the coastal hubs, AgTech has its own concentrations

Looking beyond California, Massachusetts and New York to the 20 per cent of AgTech funding that occurs elsewhere in the United States can provide insights for Australia.

In 2018, Texas, Washington and North Carolina were the third, fourth and fifth highest ranking states for US venture capital, each attracting just over 2 per cent of the national total of investment.32

But when it came to AgTech, Texas and Washington ranked 12th and nineth, with just 1 per cent of national AgTech investment combined.33 North Carolina, on the other hand, rose to fourth in the country for AgTech investment, capturing more than 5 per cent of the national total.

Table 1: Comparison of general and AgTech venture capital investment (2018)

|

|

Venture capital invested (US$ million) |

AgTech venture capital (US$ million) |

State ranking for general VC |

State ranking for AgTech |

|

Texas |

$3,070 |

$33 |

3 |

12 |

|

Washington |

$2,944 |

$60 |

4 |

9 |

|

North Carolina |

$2,693 |

$414 |

5 |

4 |

Seattle in Washington and Austin in Texas are both Startup Genome global top 20 ecosystems,35 and the seventh and nineth top metro areas for venture funding in the United States.36 So why didn’t they stack up for AgTech funding?

AgTech is what Startup Genome refers to as a sub-sector, or a niche industry specialisation. Specialisation measures the existence of supporting factors and the performance of start-ups in an ecosystem within a sub-sector such as life sciences, gaming, FinTech or AgTech.

Although not all start-up ecosystems have a specialisation, start-up ecosystems that do have a sub-sector specialisation, including in AgTech, can encourage, deliver and support large numbers of companies in this sub-sector.

While Seattle and Austin are both mature, global top 20 ecosystems,37 neither of them have this AgTech specialisation. North Carolina’s Raleigh-Durham, on the other hand, with its Research Triangle Park, existing biotech cluster and significant agricultural economy,38 has a strong specialisation in AgTech that has produced a number of successful companies. Examples include AgBiome (US$136 million raised) and Boragen (US$10 million raised).39

Specialisation can be a powerful competitive advantage

The power of sub-sector specialisation to give smaller ecosystems a competitive advantage over larger, more mature start-up ecosystems can not be underestimated.

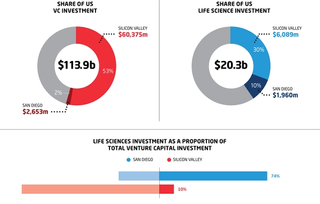

Take San Diego’s life sciences ecosystem for example. San Diego is the sixth metro in the United States for venture capital, capturing around 2.5 per cent of general US venture capital in 2018.40 Of the US$20 billion invested in life sciences across the United States in 2018, San Diego captured US$1.96 billion or nearly 10 per cent of the national total.41 This made up around 7 per cent of global funding into the life sciences in 201842 and saw San Diego rank top three in the world for its life sciences ecosystem.43

With San Diego’s relatively small size, how is this performance in life sciences possible? San Diego has an extremely strong specialisation in life sciences,44 reflected in the proportion of its venture investment that is directed into life sciences: nearly 75 per cent (see Figure 5).

Figure 5: Venture funding in Silicon Valley and San Diego (2018)

Australia should look to American specialised ecosystems and set bold aspirations

Understanding the dynamics of American tech and AgTech ecosystems provides insight into the potential for Australian AgTech to become globally competitive.

Given the immense differences, Sydney and Melbourne cannot hope to compete with the leading start-up ecosystems of Silicon Valley, Boston and New York. However, Australia can learn from the success of smaller ecosystems like San Diego that have been able to achieve success through targeted specialisation in sub-sectors. Developing a strong sub-sector specialisation in AgTech within Australia’s start-up ecosystems is a viable path toward a place on the global AgTech leaderboard.

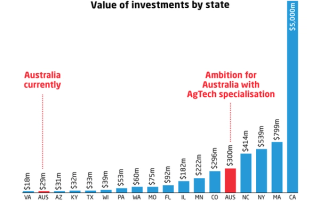

Today, AgTech represents around 2 per cent of venture capital investment in Australia.47

If AgTech reached a 20 per cent share of venture capital investment in Australia, equivalent to US$300 million,48 this would position Australia 5th when compared against American states for AgTech funding.49 Although this is still far behind California, it is within reach of North Carolina and even New York. Such an achievement would put Australia on the map globally for AgTech.

To achieve this goal, Australia must look to smaller ecosystems in the United States that have already established a global reputation for AgTech. St Louis, Missouri is a particularly strong example of a small, highly-specialised ecosystem that has been noticed globally for its AgTech performance.

Figure 6: Looking beyond the leading US start-up ecosystems, San Diego is more closely positioned to Sydney

Figure 7: Building AgTech specialisation in Australian start-up ecosystems is both ambitious and achievable

The example of St Louis: An AgTech specialisation 20 years in the making

A well-known example of a smaller US start-up ecosystem with an AgTech specialisation is St Louis, Missouri.

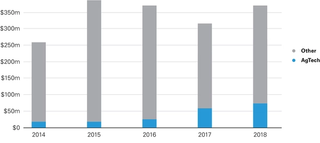

Missouri attracted US$643 million in general venture investment in 2018, less than half of one per cent of the US national total.50 Companies in the Greater St Louis metro area captured US$378 million of this across 67 deals.51

AgTech investment made up 20 per cent of this investment, reaching US$75 million in 2018.52 Figure 8 shows AgTech’s increasing deal value and share of investment in St Louis over the past five years.

Figure 8: Venture capital investment in St Louis by sub-sector, 2014-2018

While St Louis is not covered in the Startup Genome report, it is well recognised as an AgTech hub.54 St Louis is home to an estimated 400 AgTech companies55 and has attracted nearly US$200 million in venture capital into AgTech companies since 2014.56 AgTech and biotech investment together accounted for 61 per cent of venture investment in St Louis in 2018.57

A selection of St Louis’s AgTech companies is presented in Table 2.

Table 2: Leading St Louis AgTech companies

|

Benson Hill Biosystems |

US$94 million raised |

Benson Hill Biosystems’ CropOS™ is a cognitive engine that provides decision support to accelerate crop improvement and enhance the sustainability of food, feed, fibre and fuel production. The company’s platform focuses on discovering traits that would improve photosynthesis and therefore yield in crops and helps guide discovery by predicting outcomes in crops from certain traits, enabling breeders to acquire information on crosses they want for certain crop traits. |

|

New Leaf Symbiotics |

US$54 million |

Based out of BRDG Park, NewLeaf Symbiotics is a bioagriculture company dedicated to sustainable agriculture, innovative research and product development. The company’s proprietary platform, called the Prescriptive Biologics™ Knowledgebase, identifies M-trophs (symbiotic bacteria) that are especially important for strengthening plants, increasing root mass, improving plant growth and enhancing nutrient uptake for higher yield and better crop quality. Its Terrasym™ technology infuses plants with M-trophs that improve nutrient uptake, making crops stronger, more stable and more tolerant of stress up until the day they are harvested. |

|

Arvegenix |

US$5 million |

Arvegenix Inc engages in developing, genetically improving and commercialising field pennycress as an oilseed crop that is used to produce oil for industrial and renewable fuels, and meal for nutritious livestock feed. |

|

Agrivida |

US$64 million |

Agrivida is developing and commercialising a new generation of enzyme solutions that incorporate novel, regulated proteins precisely engineered for specific applications. Enzymes — biological molecules that catalyse chemical reactions — are used throughout industry and agriculture to increase production yields, enhance product performance and reduce processing costs. Agrivida’s proprietary INzyme™ technology precisely controls enzyme activity to drive these natural catalysts to deliver unparalleled performance. |

|

Nanoguard |

US$6 million |

Nanoguard Technologies is developing cold plasma technology for the treatment of grains. Its cold plasma technology facilitates food sanitation technology which is designed to preserve the freshness and wholesomeness of food while improving its safety from food-borne illness. |

St Louis is also growing faster in AgTech investment than in generic tech. While 2018 levels of venture capital investment in St Louis are around 50 per cent higher than in 2014, AgTech venture investment has increased by more than 4.4 times over the same time period.59

St Louis’ $75 million in 2018 AgTech investment places Missouri as the 10th highest ranking state in the United States, attracting nearly as much capital into its AgTech companies as Ireland or Singapore, and more than triple Australia’s total AgTech investment in 2018.

What has driven this increase in St Louis? Sustained investments over the past two decades to develop an entrepreneurial ecosystem around the local plant and life science research and corporate endowments are coming to fruit, with locally founded and externally recruited companies attracting significant rounds of funding as they reach technical and commercial milestones.

St Louis’ endowments

Startup Genome categorises AgTech as a ‘deep tech’ sub-sector.60 In contrast to software start-ups, deep tech companies require technology breakthroughs and tangible IP, such as research from universities, to succeed. Since start-up ecosystems looking to specialise in deep tech require traditional cluster endowments, research institutions are important anchors of these start-up ecosystems, providing intellectual property, research infrastructure and highly-trained researchers.61 Figure 9 summarises St Louis’ endowments.

Figure 9: Endowments St Louis has harnessed for AgTech specialisation

Research institutions and universities

St Louis has a strong reputation for plant science research through the Danforth Plant Science Center and several local universities. In fact, St Louis claims the highest concentration of plant science PhDs in the world — more than 1,000 at last count.62

The Danforth Plant Science Center is the world’s largest independent research institution dedicated to plant science. Founded in 1998, it employs more than 260 people, including more than 190 scientists and scientific staff, with more than 90 holding PhDs.6364 With a US$30 million annual budget, the Center is affiliated with Washington University, University of Missouri Columbia, University of Missouri St Louis and Saint Louis University.65 The Danforth Plant Science Center is a core part of St Louis’ AgTech specialisation, convening stakeholders and providing facilities, intellectual property and future AgTech entrepreneurs.

|

Example Benson Hill Biosystems, one of the biggest AgTech success stories out of St Louis, has its roots at the Danforth Plant Science Center. Benson Hill co-founders, Tom Brutnell and Todd Mockler, are both faculty members of the Donald Danforth Plant Science Center, where research for Benson Hill’s platform, PSKbase, began. Benson Hill has since raised a US$60 million Series C funding round in 2018 led by Google Ventures, bringing their total funding to date to US$99.7 million. |

Universities are also a strong asset in St Louis that have contributed to local success in AgTech. Washington University in St Louis is ranked in the global top 55 universities,66 and is home to the eighth ranked medical school in the United States.67 It is also an international leader in science and biomedical research, consistently ranking in the top four for National Institutes of Health funding.68 Genome Institute led the international effort to map the human genome, and its School of Medicine is the most selective in the United States.69

The University of Missouri (Columbia) is a land-grant university, one of 100 across the United States established through the Morrill Land-Grant Acts, which in the late 1800s enabled the creation of colleges and universities using the proceeds of federal land sales and which continue to have strong agriculture programs. Land grant universities have an additional purpose beyond research and teaching students to extend evidence-based science and modern technologies into the local community.70 The College of Agriculture, Food and Natural Resources is ranked in the top 15 in the world for animal and plant research, with its agricultural research centres operating over more than 14,000 acres.71

Local corporates

Leading agribusiness multinational corporations, including Bunge North America and Novus International, have their headquarters in the St Louis Region.72

Before its acquisition by Bayer in 2018, Monsanto — the world’s largest plant biotech company — was headquartered in St Louis where it was founded in 1901. Monsanto was a significant feeder of talent, mentoring and investment for the local start-up ecosystem.

At the time of acquisition, Monsanto had more than 20,000 employees in 66 countries with 5,400 full-time employees in St Louis alone.73[74] Bayer now has around 4,400 staff in St Louis from its acquisition of Monsanto, with plans to add 500 more positions in coming years.75

|

Example Yield Lab accelerator companies Plastomics and Arvegenix were founded by Monsanto alums, with Monsanto Growth Ventures leading a US$2.5 million investment into Arvegenix in 2015. New Leaf Symbiotics, also founded by a Monsanto alum, closed a US$18 million round led by Monsanto Growth Ventures in 2017. According to Connie Bowen, Executive Director and Co-Founder of The Yield Lab Institute, “Long-time Monsanto employees are incredibly supportive of local Agtech entrepreneurship, donating their time and, in many cases, investing personally into Agtech. Additionally, a lot of their research and talent ends up moving into the startup world." |

Other food and agribusiness corporations based in St Louis include Purina Mills, DuPont (Danisco) and Solae. Leading plant breeding company KWS, following a concerted effort by local and state government, has now established its first North American R&D headquarters in St Louis.

Developing innovation infrastructure

Of the many endowments contributing to St Louis’ modern success in plant and life sciences, one stands out above the rest: BioSTL, the local not-for-profit cluster organisation.

Two important research reports commissioned by the St Louis Regional Chamber in early 2000 outlined the major challenges for St Louis to overcome to capitalise on its plant and life science research strengths.76 These reports identified the growth and employment opportunity slipping away from St Louis and Missouri if it did not address slowing trends and impediments to growth in the local plant and life science ecosystems. These impediments included a lack of wet lab space and limited sources of early-stage capital and business support.77

One significant outcome was the founding, nearly 20 years ago, of the Coalition for Plant and Life Sciences. Now known as BioSTL, it was created to facilitate the establishment of the infrastructure for St Louis to commercialise its world-leading plant and life sciences research, and capture the economic benefits of this commercialisation.78

BioSTL has helped launch more than 150 start-ups in the region since 2001.79 Its coalition leaders comprise local and state government, universities and research organisations, investors, and major regional corporates.80

BioSTL’s key areas of activity and initiatives are outlined in Table 3 and coalition member organisations in Table 4.

Table 3: Summary of BioSTL key activities and initiatives

|

New company creation and company attraction |

|

|

Business support |

|

|

Capital-effective science facilities for companies |

|

|

Creating networks |

|

|

Coordination and capital attraction |

|

Insights from St Louis

St Louis is an instructive case study for Australian start-up ecosystems because of its comparable size. While North Carolina, mentioned previously, has a strong biotech/AgTech specialisation, it is a far larger ecosystem than either Sydney or Melbourne, at nearly US$3 billion venture investment in 2018.82 St Louis’ US$378 million in 2018 is a closer size comparison for Australian ecosystems.83

An existing cluster

Like North Carolina’s Raleigh Durham, the AgTech specialisation in St Louis has emerged from its strong biosciences cluster. The St Louis life sciences and biotech cluster is longstanding, comprising research institutions, hundreds of companies and tens of thousands of highly-skilled employees.

Specialised talent

Experienced executives from ag industry corporations like Monsanto and researchers from the Danforth Plant Science Center have been a key source of talent — both as mentors and founders.

Innovation infrastructure

Key to the success of the St Louis ecosystem is the sustained efforts of cluster organisation BioSTL, which over the last two decades has driven key initiatives including locally managed capital, education programs, facilities and grants for start-ups, connections between research and the start-up ecosystem, and the development of a strong brand for life sciences nationally and internationally.

Early stage investment

Of particular note is BioSTL’s approach to catalysing entrepreneurship through providing early stage capital. AgTech companies supported by BioSTL up to ten years ago are now scaling and attracting significant funding, as evidenced by the increasing venture capital being invested into St Louis AgTech start-ups in the last four years.84

Table 4: BioSTL Coalition member organisations

|

Washington University |

Cortex |

|

Donald Danforth Plant Science Center |

Cultivation Capital |

|

St. Louis Economic Development Partnership |

Saint Louis University |

|

Bio-Research and Development (BRDG) Park |

Nestle Purina |

|

National Corn-To-Ethanol Research Center |

Bayer Crop Science |

|

Saint Louis Zoo |

Harris-Stowe State University |

|

KWS Gateway Research Center |

BJC Healthcare |

|

St. Louis Regional Chamber |

Missouri Botanical Garden |

|

University of Missouri St. Louis |

Arch Grants |

|

Sage Capital |

St. Louis Community Foundation |

|

Lewis & Clark Ventures |

Rivervest Venture Partners |

|

Pfizer |

City of St. Louis |

Recommendations for catalysing Australia’s AgTech specialisation

A major federal government review in 2018 culminated in the report Agricultural innovation — A national approach to grow Australia’s future, which suggested a shared vision for Australia’s agricultural innovation system. While the government report is focused on the broader agricultural research and innovation system, many of the recommendations are built on here in the AgTech context.85

Recommendation #1: Catalyse AgTech specialisation in existing start-up ecosystems

Learning from the specialisation of St Louis, the low-hanging fruit for Australia lies in developing robust AgTech specialisations in the maturing start-up ecosystems of Sydney and Melbourne. These ecosystems feature existing endowments to leverage, including prestigious research organisations, large pools of capital and skilled labour forces.

Sydney and Melbourne’s general start-up scenes are thriving. Sydney is Australia’s start-up capital, home to just under 50 per cent of Australian start-ups.86 Sydney is also a hub for venture capital, attracting around 60 per cent of Australia’s venture capital funding in 2017.87

Melbourne has one of the world’s largest life sciences clusters, home to more than 650 biotech companies, 10 major medical research institutes, 10 major teaching hospitals and nine universities.88 Melbourne is also home to two universities in the global top 20 biomedicine rankings: Monash University and the University of Melbourne. Finally, more than 41 per cent of all Australian life sciences companies are based in Melbourne, employing more than 20,000 people and generating global revenues in excess of A$10 billion.89

Catalysing AgTech specialisations in these existing start-up ecosystems by leveraging research endowments, bringing together start-ups and industry, and connecting to the regions, is the foundation of a strong national strategy to help Australia become globally competitive in the AgTech industry.

Create AgTech districts in key start-up ecosystems to bring together researchers and corporates

Australia is well-known for the quality of its agricultural research, with the CSIRO ranking in the top 1 per cent of the world’s scientific institutions in research fields including agriculture and plant science.90

Additionally, the Rural Research and Development Corporations (RDCs) are a key feature of Australia’s agricultural research. The RDCs invest in research and development across the agricultural, forestry and fishing industries.91 The 15 RDCs collectively spend around A$600 million per year on research to drive profitability and productivity for Australian agriculture, funded by a levy of up to 0.5 per cent of the value of production, matched by Commonwealth funds.92

To leverage Australia’s unique strengths in agricultural research to drive commercialisation outcomes in AgTech, connection between Australian research organisations, the agricultural industry and the local start-up ecosystem must be strengthened to enable ‘knowledge spillovers’ and facilitate new innovations reaching market. These connections are critical, as Australia ranks below average globally on commercialisation and tech transfer outcomes, placing last in a 2013 OECD ranking of 33 countries for business and university collaboration.93

Building networks between researchers and emerging start-ups — as St Louis has done at the Danforth Plant Science Center — is one way Australian ecosystems can look to facilitate knowledge spillovers and enable technology transfer or spin-outs.

Building networks between researchers and emerging start-ups — as St Louis has done at the Danforth Plant Science Center — is one way Australian ecosystems can look to facilitate knowledge spillovers and enable technology transfer or spin-outs.

The Danforth Plant Science Center is an independent, non-profit research centre, employing more than 250 people and occupying more than six acres in St Louis.94 It is part of local cluster organisation BioSTL’s Board, and is connected to more than 50 early-stage and scale-up companies on campus through its BRDG Park.95 Providing these start-ups access to the equipment and researchers at Danforth on an affordable and incremental basis has enabled access by start-ups and facilitated network-building and knowledge spillovers.

In St Louis the annual Ag Innovation Showcase and the connecting infrastructure of the BRDG Park innovation district and 39North bring together AgTech start-ups, researchers and corporates.96 In 2019, Melbourne hosted the well-received inaugural EvokeAg97 event and the NSW Government has identified Western Sydney as a potential agribusiness precinct.98 This kind of targeted approach has the potential to be a substantial advancement to support the specialisation of the ecosystem and the creation of the informal networks that underpin collaboration, knowledge spillover and new ventures.

Connect urban ecosystems to on-the-ground expertise in the regions

Closing the gap between urban and regional AgTech activities, programs and start-ups is a key challenge for Australian AgTech ecosystems to address, given the geographical spread of the industry. Overcoming this challenge is an opportunity to both improve networks to support city-based AgTech start-ups to better address the challenges faced in agriculture, and to support regional AgTech start-ups to access capital and expertise required to develop their businesses.

Facilitated visits to help regional AgTech innovators connect with other start-ups and investors in Sydney and Melbourne, and for urban AgTech innovators to meet agribusiness experts and innovative growers in regional communities, would be a huge gain for both parties.

Supporting such connections could include defraying the travel cost for growers and regional innovators to attend events, set up meetings, and utilise facilities in the key start-up ecosystems. Likewise, support could include defraying the cost for urban AgTech start-ups, investors and researchers to visit farms, attend regional events, and immerse themselves in the agricultural context and communities.

A key aspect of making these visits valuable would be the role of intermediaries to help navigate and leverage the local network, curate key introductions, and facilitate a positive experience for visitors. Existing AgTech innovation initiatives in the regions, such as the recipients of Jobs4NSW and Federal Incubator Support funding, are examples of existing intermediaries with an AgTech focus that could be upskilled and incentivised to perform this role.

An important part of connecting with the regions is creating pathways to involve the agriculture industry. St Louis and other US AgTech start-up ecosystems are beginning to see that involving farmers at the outset of an AgTech start-up’s journey is important to ensure that the solutions developed are connected to the challenges that the agricultural industry faces.

For example, BioSTL has received funding to develop an early adopter grower community (see Table 3) to help start-ups identify and partner with agricultural experts, including growers, to verify, validate and trial their solutions.

“A strong ecosystem needs to include rural innovators and urban innovators, ideally working together to challenge one another’s assumptions and build upon one another’s ideas.”Connie Bowen, Executive Director and Co-founder, The Yield Lab Institute [99]

Building links between urban start-up ecosystems and regional agricultural expertise can help move AgTech in Australia forward through accelerating the co-development, testing and acceptance of new technologies, and supporting regional AgTech entrepreneurs to access capital and expertise concentrated in the cities. Supporting connectivity through programs to lower the cost of urban/regional travel, and developing platforms to connect innovators with early adopter growers for feedback and trial, can drive the greater success of specialised AgTech ecosystems in Sydney and Melbourne.

Recommendation #2: Empower lead organisations to identify and close key AgTech gaps

The 2000 Battelle report that catalysed the formation of BioSTL outlined the economic opportunity plant and life sciences presented for St Louis and the key challenges to be addressed (see Table 3). Highlighted areas to support the commercialisation

of technology included improving access to pre-seed and seed capital, infrastructure including wet lab facilities and business support programs.

This act of identifying the sub-sector-specific gaps for St Louis is key to the clarity of BioSTL’s intensive and sustained investment over the following decades into supporting the creation of new companies and providing access to capital-effective scientific facilities.

Reports identifying the economic potential of AgTech in Australia have already been commissioned,100 but Australia lacks organisations that are incentivised to enact the recommendations of such reports in a coordinated way across and for the benefit of the ecosystem — as BioSTL did in St Louis.

There is a need for organisations in Sydney and Melbourne, and perhaps even a national organisation, that has a grassroots mandate and local stakeholder funding, to identify and resolve the gaps in Australia’s AgTech ecosystems. These organisations may already exist, but lack the buy-in and funding needed to implement the required initiatives.

The empowerment of existing organisations, including through long-term aligned support from key stakeholders, is needed to ensure AgTech is an attractive and competitive sub-sector.

Make AgTech a more attractive proposition for potential founders

An organisation leading the identification and solving of gaps faced by AgTech companies would help make AgTech a more attractive sub-sector for founders by creating greater incentives, lowering the perceived risk of starting an AgTech company and reducing barriers to entry.

Attracting more founders to AgTech is a fundamental requirement for the creation of an AgTech specialisation. One measure of AgTech specialisation in Australian start-up ecosystems is the overall share of venture capital in to AgTech companies. Increasing AgTech’s share requires a number of high quality AgTech companies successfully reaching large valuations and attracting substantial later-stage venture capital.

For an AgTech specialisation to be achieved, starting an AgTech company must be more attractive than starting a ‘regtech’ or ‘proptech’ company, and more attractive than not starting a company at all.

Sydney and Melbourne’s start-up ecosystems are often viewed as in competition with one another. However, in Australia the greater competition is sectoral. There is a competition for talent and resources between corporations, research organisations, and start-ups, and between sub-sectors (e.g., AgTech and FinTech).

For an AgTech specialisation to be achieved, starting an AgTech company must be more attractive than starting a ‘regtech’ or ‘proptech’ company, and more attractive than not starting a company at all.

Attractiveness can be increased through incentives such as early-stage funding, access to business support and facilities, access to networks, perceived ease of reaching customers or gaining follow-on funding, and availability of experienced talent.

This relative attraction into AgTech as compared to other industries is why a key organisation (or organisations) focused on AgTech is needed. Waiting for the ‘rising tide’ of Sydney and Melbourne’s maturing start-up ecosystems will not see AgTech substantially increase its share of new companies created. Instead, a key organisation — or key organisations in each ecosystem — incentivised to actively identify the gaps for AgTech founders and solve them with targeted initiatives, as BioSTL did, will give AgTech a strong relative advantage to other sub-sectors.

Long-term commitment and a focus on leverage

Developing a thriving AgTech specialisation takes substantial time, not least because of the timeline of venture-backed start-ups. Companies on average take more than six years from first venture investment to exit, if they exit at all.101

Ecosystem developers must strike a balance between both providing support, facilities and early-stage funding to promising start-ups, as well as reducing barriers to entry, while steering away from subsidising uncompetitive start-ups. One measure that BioSTL uses to track its success is the amount of additional external capital its investees are able to attract.

The long-term horizon required of ecosystem developers is best demonstrated by BioGenerator’s first ever exit, occurring in 2017 after more than 50 investments by BioGenerator, and 15 years in operation.

Through BioGenerator, BioSTL has made US$23 million in investments into a portfolio of more than 70 local St Louis companies. This US$23 million has attracted an additional US$770 million in external private capital — a massive 34-fold leverage, and a clear sign of the competitiveness of these investees.102 Tracking this metric ensures that subsidisation of low-potential start-ups does not occur, as it aligns BioSTL’s incentives with commercial metrics and helps to validate the investments into these companies and into the broader ecosystem. Any Australian initiative to support AgTech start-ups must look to employ nuanced metrics like this, rather than purely focus on capital deployed in to infrastructure or investments.

Further, taking a long-term view is also critical. The long-term horizon required of ecosystem developers is best demonstrated by BioGenerator’s first ever exit, occurring in 2017 after more than 50 investments by BioGenerator, and 15 years in operation.103

While exits may take years, company success and ecosystem validation happen more quickly. Benson Hill Biosystems, recruited to St Louis in 2013, has raised US$85 million in venture funding in the past two years as its CropOS platform matures, elevating the profile of the St Louis AgTech ecosystem.104

Recommendation #3: Attract external capital and companies through a coordinated approach

Looking beyond the domestic recommendations to drive specialisation, there is a need for Australia’s AgTech ecosystems to present a cohesive front for international investors and companies.

A distinct brand narrative and a united, collaborative approach is needed to attract external capital and companies and connect them to the local Australian AgTech ecosystems. Companies large and small within an ecosystem benefit from it being recognised as a global center for AgTech, as it makes it easier to attract talent and external capital.

Through the BioGenerator and GlobalSTL, BioSTL’s international initiative, BioSTL has been successful in attracting high-growth start-ups from across the United States and internationally to set up their headquarters in St Louis. Notable examples include Benson Hill Biosystems, now one of St Louis’ biggest success stories, and Edison AgroSciences.

Creating a coordinated narrative that positions Sydney and Melbourne as two hubs of a thriving national AgTech ecosystem would help these ecosystems attract international companies and investors to further accelerate the local ecosystem.

In 2014 St Louis was successful in attracting KWS, the world’s fourth largest seed company, to set up its North American research headquarters in St Louis — beating out Research Triangle Park, Boston and San Francisco. This win was possible due to a collaboration between BioSTL, the Danforth Plant Science Center, Monsanto, the St Louis Economic Development Partnership, the St Louis Regional Chamber and the Missouri Partnership to convince KWS of the assets and strengths of the St Louis innovation ecosystem, and provide financial incentives from local and state government.105

This combination of targeted recruitment and a strong local AgTech narrative has helped the St Louis ecosystem attract companies and capital, creating jobs and local investment and adding to the AgTech narrative, compounding the value proposition of the St Louis ecosystem over time.

Austrade has started building an ‘Agriculture 4.0’ narrative and has brought together organisations and people from across the Australian ecosystem to kick-start this.106 Focusing the message down and creating a coordinated narrative that positions Sydney and Melbourne as two hubs of a thriving national AgTech ecosystem would help these ecosystems attract international companies and investors to further accelerate the local ecosystem. Specifically, it would help overseas investors decide to come to Australia in search of AgTech opportunities, and provide guidance and support in making local connections, including investment opportunities. An added benefit of such a narrative is its utility domestically, as proliferation and development of this narrative is likely to help attract new founders into AgTech in Australia.