Executive summary

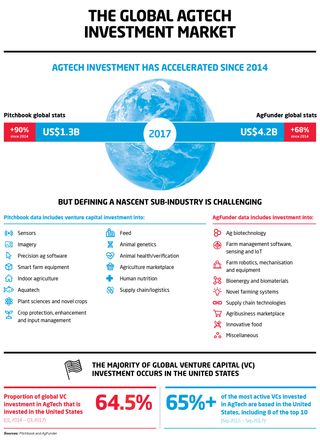

Innovation in agricultural technologies, or AgTech, is rapidly changing the world’s least digitised industry.1 Unprecedented global investment in AgTech reflects this growth, having quintupled from US$309M in 2013 to US$1.5b in 2017.2

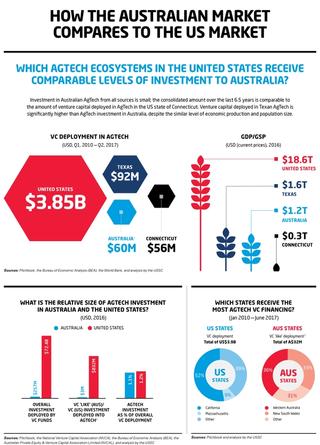

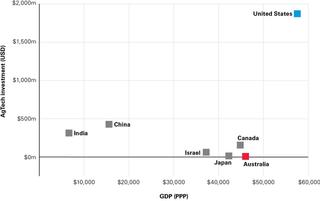

The implications of these changes for Australia are immense. While Australia’s venture capital market has expanded substantially in recent years — having doubled in total size from 2016 to 2017 alone — it invests dramatically less in AgTech on a per capita basis than most developed nations like the United States, where per capita investment in AgTech is nearly 50 times the size of Australia’s.

Australian agriculture is expected to make further inroads into export markets around the world and become a A$100 billion industry by 2030 — matching the country’s mining and construction sectors — but these ambitions cannot be met without further AgTech investment.

“Australian agriculture is expected to make further inroads into export markets around the world and become a A$100 billion industry by 2030 — matching the country’s mining and construction sectors — but these ambitions cannot be met without further AgTech investment.”

This report, the first of its kind, analyses the volume, value, and makeup of AgTech investment in Australia. It puts it in the context of the United States and provides insight into both how AgTech is developing as a new sub-industry and the broader venture capital market in Australia.

Key findings

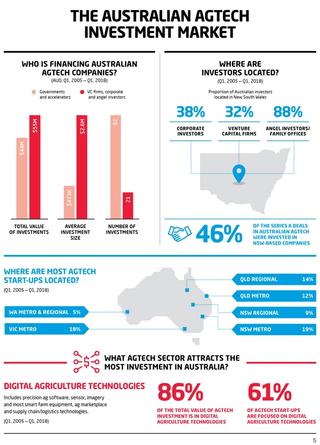

Australia’s AgTech investment market is small, at an early stage and not keeping pace with global peers

Open-source research into AgTech investments in Australia determined that whilst there has been an explosion of investment activity, the majority of investments are early and small value. In 2017, for example, 80 per cent of all investments were less than A$1m, with most being government grants and accelerator programs.

Higher value and later-stage investments — the critical sorts of funding that allow companies to scale — are largely absent from Australia’s AgTech market. This is leading to a growing disparity between Australia’s AgTech market and global trends, where there is a clear shift towards larger investments.

A breadth of AgTech segments of interest and increasing investment opportunity

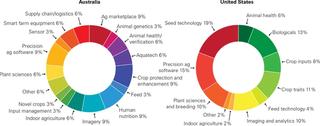

A survey conducted in collaboration with the Australian Private Equity and Venture Capital Association (AVCAL) attracted a dozen responses and enabled some comparison with US AgTech venture capital firms (VCs).

Australian investor interest was highest in digital agriculture segments of precision ag software, ag marketplace, and sensors. Segments with the lowest level of interest were novel crops, feed, and animal genetics. However, Australian investors indicated interest across a broad set of AgTech sectors.

Australian investors are seeing an increase in investment opportunities compared with perceptions of the US AgTech investors, where almost half view investment opportunities as constant or decreased over the last 24 to 36 months.

Australia has strengths to draw upon and challenges to overcome

A series of interviews with VCs making investments in AgTech — five of which are included as case studies interspersed throughout this report — brought out important insights in comparing the AgTech investment markets of Australia and the United States.

The venture capital ecosystem in the United States is mature enough to allow for the emergence of highly specialised AgTech VC firms, leading to generalist firms carving out mandates for AgTech. The lack of AgTech VC firms in Australia means this combination of extensive experience in agriculture, in tech start-ups and in venture capital is missing.

Australia’s agricultural public R&D infrastructure is seen, both locally and internationally, as indispensable for the development of a strong Australian AgTech sector. Furthermore, AgTech venture capital firms in the United States see immense value in the Australian agricultural environment as an AgTech testbed.

Policy recommendations

- Research and development: Create incentives for multinational agricultural corporations to establish major R&D operations in Australia. This would stimulate diversification of AgTech segments of focus and leverage Australia’s public R&D sector in agricultural sciences through collaboration with industry, to build commercialisation capability.

- Investors: Create incentives for sophisticated investors from overseas to open offices in Australia, particularly venture capital firms with domain experience in AgTech. This would stimulate an increase in Series A and later-stage investment flow in the sector as well as transfer domain-specific expertise to the Australian investment community.

- Technology investment hubs: Stimulate the establishment of technology-specific incubators and accelerators to create tight-knit, globally-connected investment communities around technology-specific expertise. This would allow AgTech companies in niche technology areas to access the right investors more easily and to develop confidence within the general investor community around these technology areas.

How we define AgTech

AgTech is a nascent industry at the intersection of agriculture and technology. For this reason what is included and excluded in analysis of both the size of the current market and the future opportunity varies. To enable a comparison with global markets, AgTech is defined in this report as companies selling products and/or services which contain or are enabled by patented technology into the agriculture value chain.

Some definitions of AgTech, also referred to as ‘Agrifood Tech’, include technologies relating to consumer-facing components of the agricultural supply chain, such as restaurant and retail innovations — think e-commerce-enabled meal kits such as Blue Apron or HelloFresh. The definition used by the USSC does not include these sorts of technologies.3

Follow the link for a detailed explanation of the technologies we include in our analysis.

Why is AgTech important to Australia?

Farming holds a unique place in Australia’s cultural heritage; the farm has long been known as the birthplace of the country’s wealth. Australian agriculture, in terms of gross value of farm production, is worth more than A$63 billion4 per year. Exports account for around 79 per cent of production,5 with food exports making up 11.6 per cent of Australia’s overall goods exports.6

Australian agriculture is currently predicted to grow by more than $3 billion a year to become a A$100 billion industry by 2030,7 putting it alongside mining and construction, two of Australia’s other A$100 billion industries.8 With Asia’s rapidly growing middle-class markets prepared to pay premium prices for high-quality Australian food,9 there is significant growth potential for Australia’s agriculture.

Capturing this potential will require major changes in Australian agriculture, including dramatically increasing the yield and efficiency of agricultural production, relying on fewer resources and agricultural inputs, and successfully mitigating the changing climate and an increasing risk of extreme weather events. Growers and producers will require more accurate agronomic insights, forecasting and risk assessment. Farmers will need access to tools that add significant value to farming operations in the form of greater operational efficiency and financial sustainability. Australian agricultural supply chains will also have to incorporate proven quality control measures and an absolute guarantee of provenance for consumers.

“With Australian agriculture around one per cent of the global agriculture market, bringing a global mindset to AgTech at the outset is required to develop innovative Australian agricultural technologies as a significant export.”

And yet, agriculture is one of the least digitised sectors of the global economy10 and is Australia’s least innovative industry.11

The prevalence of automation and connectivity, along with some notable exits for investors,12 is increasingly driving entrepreneurs, alongside farmers, agribusiness leaders and researchers to engage with AgTech. In the past two years, a pipeline of start-up companies has emerged as government support and corporate interest in AgTech incubators and accelerators have had the desired stimulatory effect.

Recent moves towards better commercialising the significant investment made in publicly-funded agriculture R&D is resetting Australia’s innovation culture. The Commonwealth Scientific Industrial Research Organisation (CSIRO) has noticeably shifted its focus. The collaborative Accelerating Precision to Decision Agriculture (P2D)13 project involving all 15 of Australia’s Rural Research and Development Corporations is setting out to facilitate the development and adoption of technology; and the agriculturally-focused Co-operative Research Centres are following a proven model for linking researchers with industry for commercial outcomes.14

In terms of agriculture, Australia is known for its challenging environmental characteristics, old soils, water constriction and lack of farming subsidies and, due to this, agricultural science proven in Australia is welcomed elsewhere. With Australian agriculture around one per cent of the global agriculture market,15 bringing a global mindset to AgTech at the outset is required to develop innovative Australian agricultural technologies as a significant export.

Why is venture capital important?

There have been many investigations into national venture capital (VC) markets and examinations in Australia of federal VC initiatives.16 However, there has not been a study of emerging VC sectors domestically. This report provides such an analysis using the nascent AgTech investment sector as a case study. As a first step to developing insights on how a robust VC market is created and supported, the purpose of this report is to analyse investment flows in the AgTech investment market in Australia as a means of benchmarking the sector against the US and global markets.

The global venture capital market, at US$155 billion deployed in 2017, is a relatively small asset class.17 Yet the importance of this investment vehicle to developed economies, especially in the digital age, is outsized.

In the United States, venture capital-backed companies have significantly contributed to economic growth since the end of World War II. The first publicly-owned venture capital firm, American Research and Development Corporation (ARD), established in 1946, was a new approach to entrepreneurial finance, at a time when innovation was driven by large companies using retained earnings while entrepreneurial firms were starved of capital.18 The ARD created a precedent for the venture capital investment model that has since become institutionalised in the United States.19

Over the past 25 years, the funds in the top decile with respect to performance in the United States have deployed approximately US$100 billion, similar to the amount the Australian government spends on funding education over three years.20 These funds have helped create a set of companies with a combined market capitalisation equivalent to twice the size of Australia’s GDP, while employing the equivalent of a third of Australia’s workforce.21

What is venture capital? |

|

Venture capital (VC) financing typically provides capital from investors to private businesses, which have both long-term high growth and high-risk potential, in exchange for equity. Investment is made in a series of funding rounds.22 Venture capital firms often co-invest as a syndicate, and may join other investor types to form mixed syndicates. Pre-seed and seed rounds are typically geared towards refining the development of the intended product or service, identifying market fit and establishing a sales model. In some instances, seed funding supports hiring a working team beyond the company’s co-founder(s) or early revenue flows. (For the purpose of this study defined as less than A$1 million.) Series A funding generally enables a company to create pathways to market once it has refined its product or service, understands the potential market fit and is focused on generating revenue. (For the purpose of this study defined as between A$1 million and $10 million.) Later stage Series B financing can be used for scaling operations, expansion of the team, growth into global markets and, in some cases, acquisitions of competing companies. Rounds beyond Series B (Series C, D and beyond) will generally focus on pursuing expansion into global markets. Whether a company will seek financing beyond Series B will depend on the particular needs of that company.23 (For the purpose of this study defined as greater than A$10 million.) Unlike typical stock market investment, where shares can be bought and sold instantaneously, holding periods of assets in VC portfolios are long — about five to seven years before realisation of a return. This profile of investment makes for a relatively large risk and consequently requires significant internal rates of return, usually around 20 per cent. |

Stanford University analysis shows 42 per cent of public US companies founded after 1974 are VC-backed. VC-backed companies also account for 38 per cent of the overall employment created by post-1974 public US companies, and 85 per cent of the total R&D spend.24 In 2015, three of the world’s five largest companies were US companies that received most of their early external financing from VC.25

While the United States is the clear leader in the venture capital market, in recent years other nations have recognised the power this asset class has for growth, with China and Israel becoming increasingly active.26 Chinese start-ups raised almost half all reported venture capital in Q2, 2018, eclipsing North American fundraising for the first time.27

Australia

The past six years have seen the VC sector in Australia achieve significant growth. In 2017 more than A$1 billion was raised, double the amount raised in 2016.28 The funds raised by VC firms in the 2015 and 2016 financial years are larger than the combined amount raised over the six preceding years.29

Several factors are driving this, including the persistence of low interest rates post-Global Financial Crisis driving investors from debt to equity, increased commitment from superannuation funds,30 engagement from corporate investors31 and the re-emergence of public sector VC.32 The vast majority of private sector investment behind the VC fundraising of FY2015-FY2017 has come from domestic sources, with only a marginal amount coming from overseas (around four per cent in 2017).33

Additionally, a shift in emphasis signalled by the federal government’s National Innovation and Science Agenda (NISA) has been credited with catalysing a national conversation around building a more diverse and sophisticated Australian economy,34 and has provided an important policy outlook for the Australian investment community.35

However, Australia is in the lowest third of OECD nations in terms of VC investments as a proportion of GDP36 and a long way behind the United States. Previous research from the United States Studies Centre looking at the indicators underpinning the Global Innovation Index identifies that the number of venture capital deals is one of the five biggest areas of difference between Australia and United States.37

There is clearly an opportunity for Australia to both learn from and leverage what is happening in the US VC market. The United States is already recognised as Australia’s most important economic partner, and as Australia’s number one source of foreign direct investment, US capital has been a crucial driver of employment, economic growth, and Australian export activity.38

In the United States, a notable shift in the venture capital market has been the decline in the number of seed stage deals since 2015,39 with over-inflated valuations, lack of initial public offering (IPO) interest, a post-mobile market evolution and the dominance of tech giants variously cited as driving this.40

AgTech

AgTech VC investment however is bucking this trend with both seed stage investment value and deal numbers steadily increasing since 2014.41 AgTech is a nascent industry and AgTech venture capital investment is small, accounting for around one per cent of total venture capital deployed in the United States.42

Venture capital is critical for growing businesses. Comparing the volume and value of AgTech venture capital in the United States and Australia has value both for understanding the development of AgTech as a new sub-industry and the venture capital market in Australia more broadly.

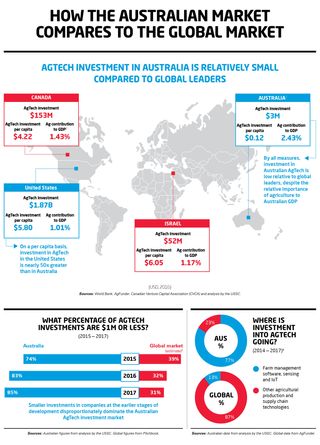

Even at this early stage of sub-industry development, looking at the relationship between AgTech investment and GDP on a per capita basis compared with global peers, Australia is lagging.

Despite the relatively higher importance of agriculture to the economy, where the value added percentage of GDP made up of agriculture, forestry and fishing for Australia (~3%) is higher than Israel, Japan, the United States and Canada (~1%);43 Australian investment in AgTech is not keeping pace with global peers. In 2016, investment in Australian AgTech by accelerators, VCs, corporate investors and angel investors was approximately equivalent to US$2.9 million.44 Investment in Japanese AgTech in the same year is nearly three times this figure, whilst Israeli AgTech is 17 times larger and US investment is nearly 631 times greater (Figure 1).

Figure 1. AgTech investment by GDP per capita (2016)

An overview of Australian AgTech investment

Compared to international standards, the Australian AgTech investment market is small, both in investment volume and in the aggregate amounts of financing. The total amount of VC-sourced capital deployed in Australian AgTech in 2017, A$6.5m, is approximately the size of one early stage VC deal in the United States.

The Australian AgTech investment market experienced significant growth in 2017, with total funding increasing by 150 per cent. Driven predominately through pre-seed and seed type investments, the two main sources of this financing have been accelerators, for pre-seed; and government grants, for seed-type investments.

Investors which typically deploy higher levels of financing, such as venture capital firms and corporate investors, have been relatively absent in Australian AgTech. The recent increase in AgTech activity in Australia is not translating into later stage investments.

Furthermore, the majority of financing in Australian AgTech is funnelled into a narrow set of technologies, particularly the digital agriculture technologies. Areas such as agricultural biotech have received a fraction of overall tracked investment dollars.

These are particularly concerning trends, driving Australia out of sync with the global market, where there is an increasing appetite for later-stage deals and a more diverse range of technology areas.

We analysed three key area of this critical sub-sector:

- investment stages, volume and value;

- sources of investment;

- and the segments attracting investment.

Investment stages, volumes and value

The Australian AgTech VC market is small in volume and value

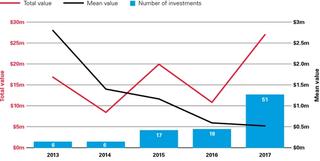

- In 2017, a total of 51 AgTech investments for all types of investment covered in this study occurred in Australia, with an aggregate A$26.98 million invested (Figure 2). In stark contrast, 117 venture capital deals closed in the United States, valued at US$1.27billion in only the first three quarters of 2017.46

- Of the half year 2017 investment flow in Australia, only A$5 million was from institutional VC, which represents less than 1 per cent of US VC deployment in AgTech,47 or 2.7 per cent of all Australian VC capital deployed in the same period.48

- The total of the strictly VC-led deals in Australian AgTech in CY2017 (US$4.6m) is similar to the median value of a single Series A VC deal in the United States in 2016 (US$4.1m).49

Figure 2. Annual aggregated values of investment in the Australian AgTech market

Growth in Australia’s AgTech investment market is being driven by a dramatic increase in pre-seed type investments

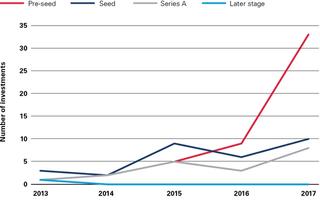

- The number of pre-seed stage investments in 2017 was three times larger than in 2016 (Figure 3).

- Pre-seed stage investments dominated the market in 2017, with four times the number of Series A investments.

Figure 3. Annual number of investments in the Australian AgTech market, by type

Recent expansion in the Australian AgTech investment market has not translated into higher-value Series A and later-stage investments for Australian AgTech start-ups

- In 2017, the Australian AgTech investment market more than doubled from the year prior, with total funding increasing by nearly 150 per cent and the investment volume increasing by 168 per cent (Figure 2).

- However, the significant increase of investment in Australia has not translated into an increasing average investment size (Figure 2).

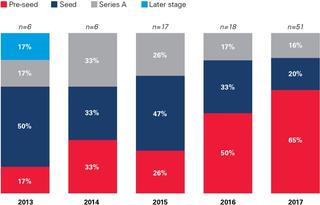

- Pre-seed and seed-type investments account for four-fifths of all activity and have been an increasing proportion of investments in recent years (Figure 4).

There is a growing disparity between Australia’s AgTech investment market and global trends

- The average AgTech investment size in the first half of 2017 in Australia decreased by 44 per cent from the average AgTech investment size in 2015 and by 73 per cent from 2013. In the United States, the average AgTech investment size in the first half of 2017 increased by approximately 29 per cent and 40 per cent from the average AgTech investment size in 2015 and 2013, respectively.50

- The average Australian AgTech investment size has not exceeded A$1 million since 2015.

- Global AgTech sector trends indicate increased appetites for later stage and large deals. This is particularly true in the US AgTech investment market, where there have been significant later-stage rounds into companies such as: Cibus – US$70 million (Series C);51 Indigo – US$156 million (Series D);52 Farmers Business Network – US$110 million (Series D);53 Plenty – US$200m (Series B).54

- Furthermore, the proportion of pre-seed and seed type investments has grown in the Australian market from 67 per cent of all investments in 2013 to 85 per cent in 2017 (Figure 4), while the proportion of similar investments in the global market is consistently around the 30-40 per cent mark.55

- In Australia there were no later-stage investments in 2017 (Figure 4), in stark contrast to global markets in 2017 where approximately 25 per cent of deals financed were more than US$10 million.56

- In the same time period, deals of US$10 million or more accounted for 86 per cent of the value of overall financing in the global AgTech investment market.57

Figure 4. Percentage of overall investments in Australian AgTech at each stage

How did we get here?

There are several potential explanations for the trends in the Australian AgTech investment market.

The AgTech market in Australia is nascent and may simply be at an earlier stage of development, compared with other AgTech markets. AgTech-specific accelerators only emerged in Australia in 2017, with SproutX being the first in this space.58 Since then, five other Agrifood Tech accelerators have been established in Australia,59 with 40 early stage AgTech start-ups participating in the first cohort of Agrifood Tech accelerator programs nationally in 2017.60

Federal government ‘Accelerating Commercialisation’ grants provided to AgTech companies in 2017 was double the 2016 number. These grants represent the greatest source of investment in AgTech in terms of the number of investments made and provide a maximum of A$1 million in matched financing to companies, making the Australian government an early-stage non-equity investor.61

This surge in pre-seed and seed-type financing from accelerators and government grants seen in 2017 likely represents a necessary first step in the ecosystem’s development. Companies receiving financing from government grants and accelerator programs may seek follow-on financing in coming years in the form of Series A investments.

“A lack of experience may exist within the Australian investment community in regard to assessing risk and pricing investment opportunities accordingly.”

Three Series A deals in late 2017 to Q3 2018 have already followed this path; with Agridigital (A$5.5m, February 2018),62 Flurosat (A$1.5m, December 2017)63 and AgriWebb (A$14m, August 2018)64 all previous recipients of Accelerating Commercialisation grants.65 Flurosat is a graduate of the Cicada Growlabs accelerator program66 and AgriWebb a graduate of Telstra’s Muru-D accelerator program.67

However, with US venture cycles between three and 18 months for the transition from seed to Series A investment, it is clear Australia’s AgTech investment trajectory isn’t following the United States as evidenced by the low level of Series A deals following AgTech activity from 2013 onwards.

Australian AgTech companies may not be good enough to merit larger investments. The market in Australia is small and the domestic market opportunities are likewise small. The current cohort of early-stage AgTech companies in Australia may not be hitting the milestones and metrics that Series A investors need to see, for example evidence of traction in the form of revenue.

It could be that Australian AgTech companies are not focused on large market problems and are too domestically focused, or that not enough of them are working in cutting-edge, novel or unique marketspace.

Longer lead times and greater complexities in product development and sales than in other sectors may require AgTech companies to seek multiple rounds of lower-level funding over a longer period of time. AgTech remains one of the most underinvested sub-sectors in the global start-up ecosystem as a result of long product development and sales cycles, and lower growth rates than other sub-sectors.68 Given the Australian AgTech sector is at an earlier stage than the United States, this trend may be even more pronounced for Australian AgTech companies. Indeed, USSC analysis saw multiple cases of AgTech companies securing multiple pre-seed/seed-stage investments in the form of government grants, accelerator programs and angel-type financing from family offices, angel or corporate investors.

A lack of experience may exist within the Australian investment community in regard to assessing risk and pricing investment opportunities accordingly.

While these factors may be playing a role, it is nevertheless the case that Australia’s AgTech investment market seems to be moving out of sync with global markets, particularly the United States, where increasingly later stage investments driven by VC investors is becoming the norm.

Where Australian AgTech investment is coming from

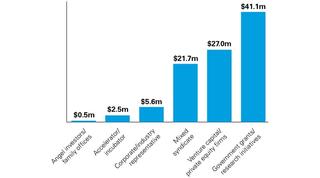

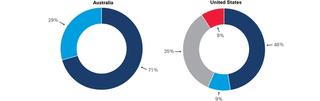

Over the period captured by our study, 2005 – Q1 2018, financing from venture capital, corporate investors, and angel investors or family offices has contributed to 21 AgTech investments, accounting for about 53 per cent of the overall value deployed in the Australian AgTech market and an average investment size of A$2.6 million.

In contrast, governments have contributed 50 investments with an average value of A$820,365 between 2012 – Q1 2018, while accelerators have contributed 42 investments with an average value of A$59,691 over the same period.

The outsized role of government in Australian AgTech

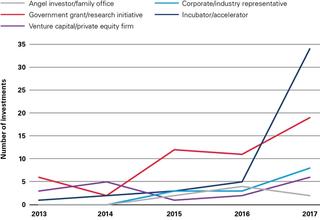

Between 2005 and the first quarter of 2018, more than 65 per cent of Australian AgTech investments have been financed by government grants and research initiatives, incubators and accelerators, with that amount rising to 88 per cent in 2017 (Figure 5). Indeed, taken in aggregate, the federal government has been the most active single financer of Australian AgTech companies.

Figure 5. Number of investments in Australian AgTech, by investor category

The amounts of funding provided through government grants and accelerator programs are similar to that provided through pre-seed and seed type investments and are less than A$1M.69

AgTech-specific accelerators emerged in 2017 and became the major contributor of AgTech investments in that year, accounting for 55 per cent of overall investment volume in 2017. However, accelerators contributed less than 10 per cent of the overall dollar value of investment in AgTech.

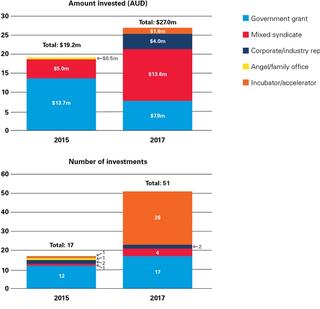

In the same year, governments contributed nearly three times the number of investments contributed by the corporate investor and mixed syndicate categories combined. Yet the value contributed by governments was only 44 per cent of the value contributed by these two investor categories (Figure 7).

Figure 6. Twelve-year cumulative aggregate investment in Australian AgTech, by investor category

(Q1, 2005 — Q1, 2018)

VCs, corporate investors and mixed syndicates

While government funding represents the greatest number of investments within Australian AgTech, the combination of VCs and mixed syndicates represent the largest value, making up 47 per cent of the total amount invested (Figure 6). This financing principally funds the small number of Series A investments as corporates and VCs don’t traditionally invest at pre-seed or seed stage.

Outside of mixed syndicates, corporate investors contributed a total of seven investments to Australian AgTech from 2015 to early 2018, including three Series A-size investments at a combined value of A$5 million, and four investments — taking the form of competition prizes and seed financing — at a combined value of A$625,500.

Figure 7. Growth in value and number of investments in Australian AgTech from 2015 to 2017, by investor category

Mixed syndicates, which include corporates, made four investments at a combined value of A$12.1 million. We approximate that through Series A investments, corporate investors, including those investing as part of a mixed syndicate, have contributed nearly 22 per cent of aggregate financing of Series A deals (Figure 8) and nearly 10 per cent of the overall financing in the Australian AgTech investment market.

Despite having an investment count that was one-tenth the number of investments contributed by governments in 2015, the mixed syndicate category contributed more than 36 per cent of the aggregate value invested by governments (Figure 7). In 2017, corporate investors outside of mixed syndicates contributed only two of the 51 investments recorded for the year. However, the aggregate value of these two investments represents nearly 15 per cent of the overall value of investments made into Australian AgTech in the same year (Figure 7).

Syndicates comprised of multiple investor categories counted for seven investments from 2005-2018 (six per cent of overall deal count), and 21 per cent of overall investment value in the sector.

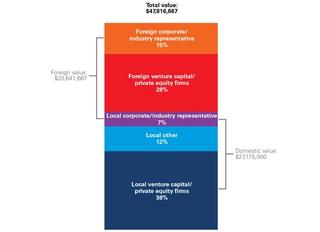

Figure 8. Proportion of total Australian AgTech investment in Series A deals generated by foreign and private sector investors

Amount estimated by splitting syndicates (Q1, 2005 — Q1, 2018)

Foreign and local investors

While some investments are financed by syndicates containing both local and foreign investors, we estimate local investors have contributed 57 per cent of the private sector financing in Series A deals, around two-thirds of which was provided specifically by VC firms (Figure 8).70

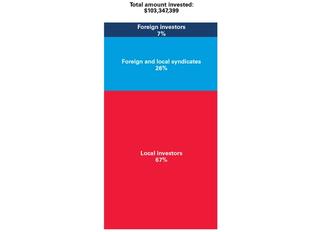

We approximate that foreign investors, including those part of a syndicate, have provided 43 per cent of aggregate financing in Series A deals. This represents 20 per cent of the overall amount of financing recorded in the Australian AgTech investment market. However, foreign investment through deals that didn’t involve partnerships with local investors only constitutes seven per cent of value in the Australian AgTech investment sector (Figure 9).

Figure 9. Proportion of aggregate values (all Australian AgTech investment stages) as generated by local, foreign and local-foreign syndicates

(Q1, 2005 — Q1, 2018)

Australian investors are currently contributing the majority of funds in the higher-financing rounds in Australian AgTech, an estimated 57 per cent of the overall value.

How did we get here?

Recognising this report is looking at a small number of investments overall due to the nascent nature of the sub-industry, looking at this investment landscape, the following can be observed:

Government and accelerators are playing an important enabling role, but private sector investment is critical for growth. The importance of corporate and VC investors is evidenced by the relatively high levels of capital deployed, typically in a smaller number of investments. While governments and accelerators play a critical role in developing the AgTech ecosystem through supporting a large number of emerging companies, AgTech companies at a later stage of development require access to higher levels of financing. The participation of private sector investors in the Australian AgTech investment market is critical to providing this financing.

Angel investment activity is notoriously difficult to collect, and not just in Australia,71 hence angel investment may be under-represented in this report. However, interviews with ecosystem members indicate there is a low level of AgTech opportunity presented to Angel investment networks, raising questions of how better to create linkages between angel investors and AgTech start-ups.

Australian venture capital investors have expertise in data-driven software products,72 however, AgTech opportunity reaches well beyond this segment and building capability will require expertise from elsewhere. Mixed syndicates provide an opportunity for knowledge and expertise to be transferred between investors. Where syndicates include local and foreign investors the opportunity exists to unlock far greater capital pools for companies. For instance, in Texas, a state with a similar population size and value of economic production to Australia,73 US$92 million in AgTech VC was deployed between 2010 and the first half of 2017.74 If local investors remain the main contributors of financing then smaller amounts of capital will be deployed into the Australian AgTech ecosystem, relative to the amount of capital being deployed in other markets.

Segments of Australia’s AgTech market that are attracting investment

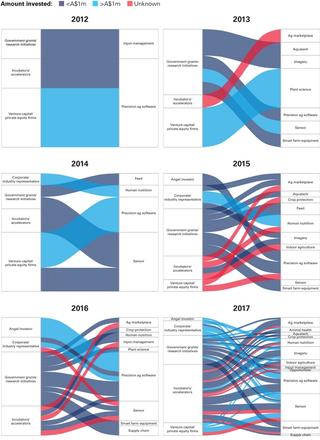

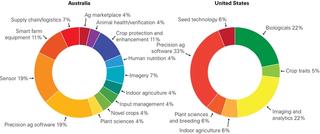

Over the past six years, Australian AgTech has significantly diversified both in terms of the sources of funding and the technology segments attracting investment (Figure 11).

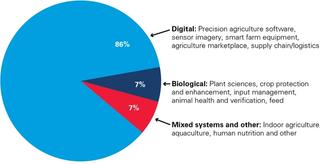

Figure 10. Proportion of Australian AgTech investment in digital, biological, mixed system and other aggregated segments

(Q1, 2005 — Q1, 2018)

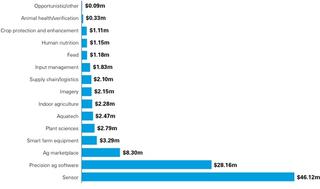

However, most of this investment is flowing to digital AgTech segments (Figure 10), with detailed analysis showing most AgTech investment activity is being directed to precision agriculture, or products providing data-driven insights to optimise farm management and yields, as well as sensors and Internet of Things (IoT) (Figure 12).

Figure 11. Money flows in Australian AgTech: Sources of investment, technology segments invested in and aggregate amounts invested

In the United States, almost half the AgTech VC investment ($860m) in 2017 went to biologic chemistries and crop protection. According to AgFunder, more than 20 per cent of global AgTech financing went into agriculture-related biological technologies in the period 2014-2017 (Figure 13).75

Figure 12. Aggregate amounts invested in Australian AgTech, by technology segments

(Q1, 2005 — Q1, 2018)

Yet, in contrast to trends in the United States and global AgTech investment markets, crop protection/enhancement and animal health/verification were two of the least invested areas in Australia. In the period 2005 – Q1 2018, biologic sciences and related areas received approximately seven per cent of overall funding in Australian AgTech, while digital technologies made up 86 per cent of the funding (Figure 10).

Figure 13. Aggregate amounts invested in technology segments as a proportion of the overall value invested in AgTech

(2014 — 2017)

How did we get here?

The focus of investment on the sensor segment is potentially an indicator of a strength in Australian AgTech. Known for its ancient soils and harsh climate, the reputation of Australian agriculture overseas is such that if something works here, there’s a good chance it will work in international locations with better soil and growing conditions.

Sensor technology, with its ability to detect and monitor changes in the physical environment and send the data collected to a central point, is applicable across multiple scenarios not just agriculture, such as smart cities and broader applications of IoT. The breadth of possibility of IoT makes it an attractive opportunity in a small market. The second biggest segment attracting investor interest, precision ag software, is likewise technology with multiple potential markets. Software is generally low cost to develop (compared with plant sciences) and relatively easy to pivot as the market shifts. It also draws on one of our strengths, a globally recognised tech talent pool. Australian investment market characteristics are also a factor, as lack of capital forces capital efficient models such as software and existing VC investment in Australia has a strong focus on ICT.76

“Known for its ancient soils and harsh climate, the reputation of Australian agriculture overseas is such that if something works here, there’s a good chance it will work in international locations with better soil and growing conditions.”

Fundamental to the success of the sensor segment in Australian AgTech is the Sense-T project, through which Tasmania is creating the world’s first economy-wide sensor network.77 Government funding for the Sense-T project led to the establishment of an advanced sensor manufacturing centre in Tasmania which has created domestic capability for sensors that would otherwise be imported.78 An important start-up that came through the Sense-T ecosystem is The Yield,79 which attracted Series A investment from KPMG, AgFunder and Bosch.80 Investment in the Sense-T project alone totals $26 million,81 accounting for half the amount contributed to the sensor technology segment overall. It’s worth noting that in a small market at an early stage, one large investment can have an outsized impact on the data.

However, if looking at the upside of where Australian AgTech is attracting investment, the downside as evidenced in Figure 13 also needs to be examined. With around 77 per cent of Australian AgTech investment going into software, sensing and IoT we don’t appear to be commercialising other important technology segments. In particular, Australia has world leading research in field robotics82 and robotic vision83 and yet investment in this segment is behind global proportions.

Bioenergy has been identified as a potential growth industry for Australia and yet is an area experiencing limited growth84 and lower proportional investment compared to global data. Likewise, the University of Melbourne’s Bio21 Molecular Science and Biotechnology Institute supports a number of world leading technology platforms85 and yet agricultural biotechnology does not appear to be leading to Australian AgTech investment in the same way as global trends indicate.

Survey analysis

This report includes perspectives and attitudes within the Australian venture capital community around investing in AgTech. These have been gathered through a survey conducted in collaboration with AVCAL of their members and other investor networks.

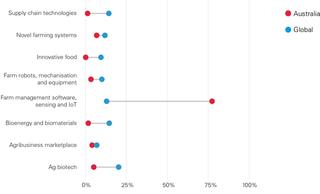

While a small number of responses to the survey potentially indicate a low general level of interest in AgTech investment, of the dozen firms indicating they did have an interest in AgTech, more than half indicated a high level of interest (three quarters indicated an above average or high level of interest). A similar survey of US venture capitalists conducted by Finistere Ventures in 2017 attracted a higher volume of responses. The Finistere Ventures survey received 39 responses in total and a response rate of 65 per cent, whereas the USSC survey received 12 responses and a response rate of 43 per cent. This may point to a cultural difference between the US and Australian venture capital communities as follow-up conversations indicated Australian VC firms seem to be more sensitive in relation to the collection of investment data than American VC firms.

In your view, over the past 24 to 36 months, the number of investment opportunities have:

A majority of firms indicated the number of investment opportunities in AgTech has increased or increased significantly over the past 24 months. Precision ag software and sensor are the two segments where Australian VCs have seen the most investment opportunities.

Australian VC firms indicated a greater breadth of both investment opportunities available and segments of interest compared with US VC firms. This is an encouraging sign for Australian AgTech and also reflects the increased activity in AgTech start-ups in Australia.

In your experience, which segments of the AgTech sector have had the most investment opportunities over the past 24 months?

The two main areas where Australian investors have identified strong growth or commercialisation opportunities are in plant sciences and animal health/verification. More than half the technology segments had either already attracted investment or were identified by more than half the investors as having strong growth or commercialisation opportunities. This indicates a general positivity towards AgTech as an investment opportunity and confidence in ongoing AgTech development.

Australian firms that were yet to make any investments in AgTech indicated the investment opportunities examined have been at too early a stage, and either don’t fit the VC returns model or haven’t demonstrated market fit or traction. This could be because many of the companies active in AgTech in Australia are at an incubator stage, working on their minimum viable product and business model, reflecting the emergence of AgTech and Agrifood incubators/accelerators over the past 18 months.

Which segments of the AgTech sector is your fund interested in investing in?

The below ranking is only of those respondents that indicated high interest in the following sub-sectors.

Note: The survey sample size in Pitchbook’s US AgTech investment survey was 39, whereas in the USSC survey on Australia’s AgTech investment survey had a sample size of 12. Given the small sample size of both surveys, we urge caution in interpretation. However, given the applicability of the survey takers, the information remains valuable.

Conclusion

Momentum is growing in Australian AgTech. There has been an explosion of activity in the very earliest stages of business formation as government stimulation86 of incubator programs has driven AgTech specific cohorts in the last 18 months.

In parallel, venture capital funds are at a record level in Australia, boding well for the support of a strong Australian AgTech industry, and our export aspirations for both agricultural products and technology products and services.

The challenge for Australia is how to move from where we are today to a flourishing AgTech industry. In terms of volume of AgTech start-ups, the current trajectory is positive, however the funding sources, values of investment and limited AgTech segments attracting investment as set out in this report point to some areas of focus.

A global mindset is important in attracting investment

The explosion of very early stage companies with funding sufficient for minimum viable product or proof of concept development in Australia will require additional investment to achieve scale. Australian AgTech start-ups need to look beyond the domestic market for customers and take a global market perspective. This is particularly important given that Australia is lagging the United States on maturity in the digital agriculture technologies sector, especially in the domain of predictive and prescriptive analytics platforms.87

“There is a real need in the domestic market to find and recruit foreign lead investors — who both understand and have networks in the global AgTech space — to invest alongside domestic groups in later-stage deals.”

To address funding sources and values, opportunities exist in building bridges between US venture capital and Australian venture capital in AgTech, particularly in light of broader early stage pipeline weakness in the United States, the attractiveness of Australian companies and the relative lack of agriculture experience in the Australian VC landscape.

There is a real need in the domestic market to find and recruit foreign lead investors — who both understand and have networks in the global AgTech space — to invest alongside domestic groups in later-stage deals. This would help to transfer AgTech expertise to the Australian investment community and create market relationships that will help grow the start-up community in Australia.

Research is all well and good, but commercialisation unlocks its value

There are far fewer science-based technology companies than digital tech companies being funded in Australia. In contrast to the United States, where the commercialisation of university research has long been a feature of the US innovation ecosystem,88 in Australia commercialisation of IP is challenging. CSIRO, however, is seen as a key asset in Australia’s innovation ecosystem and was mentioned in all the case study interviews. The shift in focus of the CSIRO in recent times and the role their investment fund, Main Sequence Ventures, will play in providing access to research with commercial potential is critical.

It’s worth noting that none of the “Big 3” global agrochemical companies — Monsanto-Bayer, Dow-DuPont, and Syngenta-ChemChina — have significant in-house R&D activity for biologic chemistry in Australia. Indeed R&D spending by large agriculture technology firms is almost non-existent in Australia. This is likely impeding both plant science and chemistry commercialisation as business R&D by anchor firms plays an important role in the development of new products and services both within and external to those firms.89 This has been true in the case of the R&D relationship between Bosch, which has a presence in Sydney and Melbourne,90 collaborating with The Yield in Tasmania to develop their microclimate sensing system.91 According to Bosch, “Tasmania is a good testbed of agricultural technologies because of its diversity of agriculture in a compact area and the ability to connect with those industries.”92 Without in-country R&D for global markets by multinationals like these agricultural powerhouses, Australia will continue to lack domestic commercialisation talent with global market understanding and product development expertise.

Without in-country R&D for global markets by multinationals, Australia will continue to lack domestic commercialisation talent with global market understanding and product development expertise.

Since the 2013 acquisition of Climate Corp by Monsanto (US$1,100m), there have been a number of notable AgTech acquisitions by the Big 3, including Granular (2017, US$300m, DuPont) and CRISPR Therapeutics (2016, US$91m, Bayer)93 indicating an appetite to acquire complementary technology as well as develop their own. A lack of global players in Australia means Australian technology is much less visible to large potential customers and acquirers.

Lack of R&D investment by business (or BERD) is a known challenge for Australia; at 1 per cent of GDP it is half that of the United States.94 However, Australia does have a record of success through the Cooperative Research Centres (CRCs), industry-led, end-user driven companies formed through the collaboration of businesses and researchers. The net economic benefit to the community of the CRC program has delivered an estimated A$14.5 billion of direct economic impacts over the past 26 years with a 3:1 return.95

The Food Agility CRC96 and the Sheep CRC97 are focused on addressing major challenges and opportunities facing Australia. These industry-led initiatives, along with the renewed leadership of the CSIRO in focusing on addressing Australia’s gaps in commercialisation of R&D are starting to address the pipeline of AgTech opportunity, however we need to look beyond government to grow a strong industry.

Comparative advantage in IoT presents a potential AgTech strength

The digital tech companies attracting AgTech funding in Australia may indicate areas of relative strength. The Australian agricultural environment is seen as an asset, providing a testbed for the North American market due to tough agricultural conditions, a counter-cyclical seasonal pattern, and a similar supply chain model. Companies such as Myriota and The Yield are often cited as the leading examples of AgTech innovation in Australia. Both companies have attracted Series A investment and both use IoT technologies working to solve the challenges of poor connectivity and diverse climate conditions.

IoT technologies are applicable more broadly than agriculture, spanning cities, energy, transport, manufacturing and health. Building capability across such enabling technology is a smart move for a small nation. Austrade recognises Australia has comparative advantages in IoT with global industry leaders including Cisco, Microsoft, IBM, SAP, Ericsson and Bosch investing in Australian capability. The global IoT market will be worth US$1.3 trillion in 201998 presenting a huge opportunity for market capture.

These three areas, attracting international firms to invest in R&D in Australia, taking a commercial focus to our extensive strengths in agricultural R&D and developing areas of relative comparative advantage are key to the growth of AgTech.

American VC investors will be attracted to emerging deal flow where there are clear global market opportunities, scalable and unique products or services, robust business models, committed founders and a solid exit strategy. Ecosystem supporters need to focus their efforts and Australian AgTech founders need to have these factors front of mind as they develop their start-ups.

Policy recommendations

Create incentives for multinational agricultural corporations to establish major R&D operations in Australia

Digital agriculture technologies make up nearly 86 per cent of investment dollars in Australian AgTech, with animal health/verification and crop protection/enhancement some of the least invested areas. Globally, AgTech investment is more evenly distributed across the technology landscape.

None of the Big 3 AgriChemical firms or large multinational Agrifood business have significant R&D operations in Australia to drive local product development and provide a de-risking platform. Increased collaboration between existing R&D centres and agricultural-multinationals could leverage Australia’s existing strengths (including in genomics) to drive product development in the biological science spheres of AgTech.

Incentives to attract multinational corporations need to focus beyond merely sales and marketing outposts on Australian-based, global market-focused product development in addition to research, as this is a key set of skills that will increase Australian commercialisation capability. There is significant demand for product development/management skills globally,99 recognising their critical impact on commercialisation.

Create incentives for foreign investors to be more involved in the Australian AgTech investment market

Australian AgTech investment is characterised by a low level of Series A and later stage deals led by local VCs and institutional investors. To accelerate scale, foster growth and develop sector specific expertise, investment from foreign VCs will be required.

“Australian policymakers should look to incentivise sophisticated AgTech investors from overseas, particularly from the United States, to access world-leading expertise in this sector and to take advantage of the major source of AgTech capital.”

Australian policymakers should look to incentivise sophisticated AgTech investors from overseas, particularly from the United States, to access world-leading expertise in this sector and to take advantage of the major source of AgTech capital.

Incentive structures should encourage foreign investors to:

- Establish Australian offices (several established American VC firms with AgTech expertise have international offices in a range of global locations, including Innovation Endeavours in Silicon Valley and Israel,100 and Arch Venture Partners in Chicago, Seattle, San Francisco, Austin and Ireland).101

- Partner with local AgTech accelerators (with a view to having active participation in the selection of cohorts, the mentoring process and possible follow-on financing).

- Create strategic affiliations/partnerships with Australian investment firms and participate in or lead investment syndicates in Australia.

Australia’s Early Stage Venture Capital Limited Partnerships program goes a little further than similar US tax incentives for VC firms, however it doesn’t appear to be appealing enough to attract American VCs to establish offices in Australia. Israel famously established its now thriving VC ecosystem through the Yozma program which operated through government policy between 1993 and 1998102 to create a competitive VC industry with critical mass, learn from foreign limited partners and acquire a network of international contacts.103 According to the OECD and measured by VC investments as a percentage of GDP, Israel is now the world leading country, ahead of the United States.104

Establish technology-specific accelerator and investment hubs

Technology-specific AgTech accelerators feed into corporate and venture capital investment networks where lead investors have relevant domain expertise. In the United States, AgTech investment led by venture capitalists with AgTech expertise have created confidence amongst generalist investors, attracting them to syndicated deals. This has prompted technology expertise transfer across the investment community allowing highly technology-specific companies to access larger pools of capital. This is a unique characteristic of the American VC AgTech investment market compared to the broader VC investment market, but has led to the expansion of the US AgTech sector,105

Australia already has at least six Agrifood accelerator programs in 2018. Two years ago there were none. This volume of interest indicates there may have been some latent demand for specific AgTech support. Opportunity may exist to become more targeted in focus — along the lines of well-known international accelerator, Techstars — with specific accelerator programs focused on specific technologies including Internet of Things in New York City106 and Mobility in Detroit.107 Key in this is the quality of incubator and accelerator programs, clearly they need to be preparing companies to be ‘Series A ready’.

The Australian government already supports new and existing incubators.108 The onus is on those with the most to gain from a strong AgTech ecosystem to take advantage of the opportunity on offer, build a pipeline of start-ups and fund the promising ones through incubation, acceleration and into the global market.

The link between R&D, commercialisation and start-ups |

|

In 2012 Bayer CropScience acquired AgraQuest Inc for US$425m.[^109] Of key interest in the acquisition was both the tailor-made portfolio of products and the promising R&D pipeline presenting Bayer with the opportunity to build a leading technology platform for green products, due to AgraQuest’s innovative biological pest management solutions based on natural microorganisms. AgraQuest’s R&D site in Davis, West Sacramento, California was a key part of the acquisition. Subsequently this became the global headquarters of Bayer’s Biologics group within Bayer CropScience,[^110] and a centre of excellence for R&D on innovative biological pest management solutions. In 2018 Bayer opened the Crop Science CoLaborator in West Sacramento (its third such facility globally), forming a strategic collaboration with UC Davis and joining the university’s Distributed Research Incubation and Venture Engine network of start-up incubators to support development of research and new technologies into new commercial ventures.[^111] Part of the attraction for start-ups is the facilities and part is the cluster of biologic companies and other agriculture technologies in the local area and those associated with UC Davis.[^112] For Bayer, a commitment to internal research is critical to long-term success and the CoLaborator, enabling their researchers to work with those outside the company, is seen as an important source of innovation.[^113] |

Case studies

A series of interviews with AgTech investors in Australia and the United States resulted in five case studies shown below. Three of the case studies feature Australian VC firms that have made AgTech investments, two are American AgTech-specific VC firms.

The most striking insight was how much American VC firms are able to specialise their investment portfolios into specific sectors like AgTech — to a much greater extent than their Australian counterparts. The United States enjoys unrivalled diversity in both investment opportunities and capital while Australia is not only a smaller market but is also characterised as rich in resources and poor in capital. Australian VC firms cannot limit themselves to focusing exclusively on specific sectors like AgTech — there is simply not enough on offer.

“The lack of product managers in Australia is a constraint for the commercialisation of technology in Australia. The presence of multinational corporations is important to develop skills in these areas.”

Other notable differences include the extent to which the American VCs interviewed had expertise both in agriculture and in the Californian tech start-up and venture capital scene. Additionally, their personal connection to agriculture and AgTech is seen as a means to have a positive impact more broadly. Not only is this combination of expertise absent within the Australian VC firms, their motivations are more typical of any generalist VC firm with a focus on global scale, recent uptick in AgTech activity and investable founders.

The key themes from these interviews include:

- The presence of investors with AgTech expertise and increased activity in AgTech are driving the increase of global VC interest in AgTech. Australia has yet to have any big AgTech exits for investors and does not have any AgTech specialist investors. These factors impede growth in Australian AgTech investment.

- CSIRO and the public R&D system are important assets in developing an expansive AgTech innovation ecosystem in Australia. Finding pathways to commercialisation of this research is key to creating opportunities of global scale in Australian AgTech — Main Sequence Ventures, one of the entities profiled, currently acts as a key mechanism for commercialising this research.

- The Australian agricultural environment is an asset as a testbed for technologies for the North American market due to tough agricultural conditions, a counter-cyclical seasonal pattern, and a similar supply chain model.

- Digital technologies which disrupt old physical industries, improve on-farm productivity, provide connectivity in farm operations and democratise key agricultural areas (such as crop breeding and gene editing) are the technology segments of interest to both Australian and US investors in our case studies.

- The lack of product managers in Australia is a constraint for the commercialisation of technology in Australia. The presence of multinational corporations is important to develop skills in these areas.

- Start-ups, investors and governments in Australia need to have a global focus and create global connections to kickstart the expansion of the Australian AgTech sector.

AirTree Ventures

Co-founded by well-known tech entrepreneurs Craig Blair and Daniel Petre (the latter an early lieutenant of Bill Gates at Microsoft), AirTree Ventures is an Australian early and growth-stage VC firm that has quickly become an industry leader in the country. AirTree’s track record includes backing 48 companies, executing 18 exits, and earning their investments back fourfold across two prior funds.

Its first foray into Australian AgTech occurred in late 2017 when a group of investors that included AirTree invested A$1.5 million in Flurosat, a start-up that uses drones and satellites equipped with hyperspectral imaging technology to enable early detection of stress in crops. This allows farmers to increase yields while minimising inputs such as fertiliser and water.

According to AirTree partner John Henderson, the chief motivation behind all of their investments is the quality of the start-up’s team — and Flurosat was no exception. Anastasia Volkova, the 26-year old University of Sydney PhD student who founded Flurosat, is “truly world-class”, and has a “unique lens” in her area of focus, Henderson said.

Unlike more typical consumer-focused businesses that can make quick decisions based on rapidly-evolving markets, agriculture often literally takes time to grow. A key ingredient to AirTree’s usefulness as partner for an AgTech firm like Flurosat may be the fact that its long-term investment view is conducive to that sort of growth: AirTree has a 10-year fund cycle and they invested in Flurosat in the first year of that cycle.

Multiple funders were involved in the backing of Flurosat, including CSIRO’s Main Sequence VC fund. While observers may assume that competition between VC firms could result in tensions between those that collaborate in joint investments, Henderson believes this is a misnomer, saying “it’s actually really helpful to have multiple perspectives and helping hands around the table”. Collaboration between VC firms can also lead to awareness of a greater pool of investment opportunities. Main Sequence in particular, Henderson says, can open up connections to CSIRO, government grants and unique investment opportunities derived from public and university research that may not be available otherwise.

A key ingredient to AirTree’s usefulness as partner for an AgTech firm like Flurosat may be the fact that its long-term investment view is conducive to that sort of growth: AirTree has a 10-year fund cycle and they invested in Flurosat in the first year of that cycle.

In terms of future opportunities in the AgTech space, Henderson is particularly keen on two areas: synthetic meat and the use of data to improve agricultural productivity.

Henderson ultimately wants to invest in solutions to “important problems with a large market opportunity”. Regardless of where AirTree goes next, it’s hard not to see far more opportunities for those sorts of investments in Australian AgTech.

Fall Line Capital

Fall Line Capital, a Silicon Valley-based investment firm founded in 2011, invests exclusively in AgTech and broadacre farmland.

Co-founder Clay Mitchell is a fifth generation Iowa farmer who studied biomedical engineering and agronomy, and dedicated his career to becoming one of the most productive and technologically-advanced grain farmers in the world. His fellow co-founder Eric O’Brien had a successful career in finance and venture capital, including being one of the managing directors of Lightspeed Venture Partners, a premier Silicon Valley venture capital firm with more than US$3 billion in managed assets.

Mitchell and O’Brien recognised that agriculture — whether farmland or AgTech — had typically been an overlooked area of investment due to a number of challenges: it’s a nuanced asset that is difficult to simply go out and buy; ownership is fragmented and lacks transparency; there are significant differences and variability in regions; and unlike many other assets, there’s little visibility and access.

But they also saw a number of advantages to investing in agriculture. These include the fact that historical returns in the sector as a whole have beaten Standard & Poor’s index for the past 20 years. Agriculture is also uncorrelated with financial markets — making it, in comparison to other investments, the sort of relatively low-volatility asset that institutional investors often seek out. Recognising that institutional investors were interested in agricultural investment but lacked the access to make the investments, Mitchell and O’Brien realised they had a unique opportunity. They have since used that opportunity to not only invest in farms themselves, but also to improve productivity through AgTech.

O’Brien attributes the unprecedented increase in activity in the agricultural investment space over the past half decade or so to a range of factors, most notably being the large exits in the sector like Climate Corp at US$1 billion and Granular at US$300 million. Such deals feed into a virtuous cycle by attracting further investment. O’Brien also sees value in the consolidation of the major agrochemical and agricultural biotechnology firms in recent years, as well as the fact that tech entrepreneurs increasingly want to do something that has a viscerally positive impact by applying their skills to the AgTech market.

The proliferation of big data, machine learning, and artificial intelligence has essentially democratised key agricultural areas like crop breeding and gene editing — areas that previously only the major firms could afford to do — and therefore given unprecedented opportunities to small and nimble players who don’t need to navigate large bureaucracies and internal politics.

According to O’Brien, Australian farmers are widely respected in the United States for their world-class ability to harness some of the toughest agricultural conditions. The challenge he sees for Australia’s AgTech sector is in its attempts to further grow in the domestic market while also maintaining its world-class ambitions.

Square Peg Capital

Square Peg Capital is a global venture capital firm which invests in early-stage technology companies in Australia, Southeast Asia and Israel. Square Peg’s US$180 million dollar fund was announced in 2017 and has been invested into market-leading start-ups such as Fiverr in Israel and Canva in Australia.

In 2017, Square Peg completed a A$5.5 million-dollar co-investment with a private investor in AgriDigital, their first investment in the AgTech sector. Operating in the space of convergence between FinTech and AgTech, AgriDigital has developed a block-chain enabled agricultural commodity management software platform. The platform enables a more efficient movement of commodities into markets while providing farmers and businesses across the supply chain with greater transparency, faster monetary transactions and financial management solutions.

According to Tony Holt, co-founder and Partner at Square Peg, the VC firm is excited by opportunities for disruption in global agricultural supply chains and the high potential for companies to generate scale by developing world-class solutions for complex supply chain problems. As opposed to technologies for on-farm production that are often very local in scope, supply chain technologies need to access a wider range of businesses across global markets — including farms, bulk storage and end-users — to drive outcomes.

The complexity of solving problems in archaic supply chain models — particularly in speeding up the delivery of products to market, and real-time payment for delivery, financing and traceability — also lends itself to an opportunity for finding globally-scalable investment opportunities. AgriDigital’s commodity management platform can be purpose-fitted for multiple actors across the agricultural supply chain and provides a single source of records, through which traceability, financing and real-time payment can be achieved.

According to CEO Emma Weston, the Australian AgTech ecosystem has provided AgriDigital with a strong foundation for developing their technology and believes that these advantages can be leveraged to attract foreign start-ups and investors to the Australian AgTech scene.

According to AgriDigital CEO and co-founder Emma Weston, the Australian AgTech ecosystem has provided AgriDigital with a strong foundation for developing their technology and believes that these advantages can be leveraged to attract foreign start-ups and investors to the Australian AgTech scene. A strong public agricultural R&D system, similar laws, supply chain models, the use of English, and a counter-cyclical seasonal market all make the case for Australia as a strong testbed for agricultural technologies in the North American market.

Since 2016, AgriDigital has transacted 2.5 million tonnes in grains and A$500 million in payments through their platform. AgriDigital’s team have successfully adapted their platform to export markets and are looking to adapt their solution for importing markets. AgriDigital is now looking to expand further to North America to access higher levels of capital and a larger customer base. Additional markets for expansion may include countries in the Black Sea region of Europe, the breadbasket of the continent, and South America.

Radicle Growth

Based in Southern California, Radicle Growth is the only VC firm in the world specialising in seed-stage financing in the Agrifood Tech sector, which invests globally. By partnering with a range of VC firms and multinational Agrifood corporations, Radicle’s unique approach supports start-ups not yet ready to make the leap from the accelerator stage to closing a Series A financing round.

Radicle’s investment model fills a critical market gap. AgTech companies generally require more capital than other start-ups at the seed-stage as a result of the longer timeframes needed to gather the necessary data for proof of concept and product development. This means it is generally more difficult and time-intensive for AgTech start-ups to prove product-market fit and generate early revenue flows, which are critical for closing a Series A financing round.

Managing partner Kirk Haney entered the agricultural technologies sector in 2002. At that time, AgTech was not yet an asset class, with only a handful of companies built around the opportunity for innovation in agriculture. With approximately US$2 billion invested in AgTech globally in 2017, Haney sees the AgTech sector is on a trajectory of maturation. Yet he finds the amounts invested are still disproportionately lower than other sectors such as FinTech (US$12.8B), HealthTech (US$4.5B), and pharma and biotech (US$16B), especially considering the importance of food as a global market.

Radicle is particularly focused on financing digital agriculture technologies. In observing how other industries experienced exponential growth through digitisation, connected farming can create vast possibilities — from finding new pathways to market, to the opportunity for multi-crop farming and automation.

After more than 15 years in AgTech, Haney has found the global AgTech investment market to still be largely collaborative, unlike the investment markets for larger sectors that are defined by heavy competition. Investment in AgTech, Haney posits, tends to conform to capital formation strategies whereby domain experts lead investment syndicates. The interest of domain experts creates confidence within the wider investment community, which then enables AgTech innovations to access sufficiently large capital pools. Haney predicts that AgTech could see a boom of global investment activity in the next five years, leading to exponential growth in the sector and greater competition amongst investors.

As agricultural innovation cannot be limited to any one centre of excellence, the philosophy and outlook of Radicle has always been global. This is evident in the fact that 40 per cent of Radicle’s deal flow is foreign, as are 50 per cent of the companies that came into Radicle’s portfolio in 2017.

Radicle's managing partner Kirk Haney predicts that AgTech could see a boom of global investment activity in the next five years, leading to exponential growth in the sector and greater competition amongst investors.

In observing AgTech ecosystems internationally, Haney found that leading countries have largely succeeded as a result of maintaining a global strategy. Israel, for example, promotes its best entrepreneurs on a world stage instead of merely a national one. This is critical, as domestic sources of financing are generally not sufficient to support the later stages of growth for companies looking to scale globally. To this effect, Haney believes that Israel also sets a prime example of how government should contribute financing to assist in developing an AgTech ecosystem. He warned that easy access to early-stage government funding can pose a threat to an innovation ecosystem by potentially creating a disincentive for grant recipients to pursue high-value rounds of private financing. Haney also sees a challenge for ecosystems when investors merely focus on local technologies, which are preceded by replicas of foreign innovations, in lieu of searching globally for truly innovative solutions.

Haney sees Australia already has some distinct advantages for its burgeoning AgTech field, including extreme conditions that have taught unique lessons to the agricultural sector as well as CSIRO, which creates the international connections that are foundational for AgTech success. Given the significant contribution that agriculture makes to Australia’s GDP, such advantages are critical.

Main Sequence Ventures

Main Sequence Ventures is a unique VC fund in that it focuses its A$200 million fund on early-stage deep tech companies, ignoring start-ups working in lighter tech solutions in mobile applications, marketplaces, and Software-as-a-Service. What further distinguishes Main Sequence is that it was created out of a government-backed policy initiative called the National Innovation & Science Agenda, has $100m from CSIRO and the federal government, and invests exclusively in companies with ties to publicly-funded research institutions like the University of Sydney and CSIRO.

Founded in 2017, Main Sequence Ventures joined AirTree Ventures and others in investing in Flurosat, the start-up founded by a University of Sydney PhD candidate that harnesses data from drones and satellites equipped with hyperspectral technology to optimise crop yields. Main Sequence Ventures also invested in Myriota, which has AgTech applications from its use of satellite network to connect internet devices from anywhere in the world at low cost and power usage.

According to partner Mike Zimmerman, Main Sequence is “really excited by opportunities in the ag space” in Australia, having seen a recent boom of emerging AgTech solutions ranging from farm management software and analytics to robotics and genomics. He sees one of the major challenges being that Australian farmers are “pummelled with pitches for individual point solutions” which are not always practical to deploy and manage when compared with end-to-end platform solutions that aggregate functionality.

Another challenge, according to Zimmerman, may be more relevant to the broader start-up scene: the lack of good product managers in Australia. Having spent much of his career between Australia and Silicon Valley, Zimmerman has insight into both innovation ecosystems. While Zimmerman has found Australia to have excellent engineers, he says the availability of high-quality product managers — the people that sit between engineers and the markets their products serve — are in very short supply. He views the larger tech companies based in Australia (Google, Atlassian, etc) as being great training grounds for those critical skills in Australia.

A competitive advantage for Main Sequence is the fact that it works closely with the research community, so it can help its start-up portfolio companies find and access the best research connections to help accelerate their product roadmaps or improve their differentiation. For example, in the ag space, Australian research has uniquely deep pools of historical data on soil, climate, crop/livestock production and farm profitability. Global opportunities exist for companies that can access, analyse and monetise that data, giving Australian start-ups an advantage that others in other markets would struggle to create. Main Sequence wants to be there to support them and generate great returns for investors in the Australian market.

Australian AgTech investment research methodology

The main aim of this study is to understand how much money is being invested into Australian AgTech, who is investing in this sector, the proportions of the aggregate value received by each segment within the sector, and how AgTech investors view the sector. To accomplish this, a three-pronged approach was taken: open-source research to track the publicly-available data on investments made into the AgTech sector; a survey to gauge the level of interest and activity of Australian venture capital firms in the AgTech investment market; and case studies of AgTech investors in both the United States and Australia.

The nature of our research means there will be investments we have not captured. AgTech is a rapidly emerging arena with disparate players. For this reason, we have kept open our survey, designed to capture AgTech investment and encourage readers to complete it with a view to updating our data sources at regular intervals.

Investment tracking

For the purpose of this study, all transactions are referred to as investments or deals. Australian data includes government grants, funds provided to companies to participate in commercial research initiatives and capital provided to companies to participate in incubator or accelerator programs. In cases where the amount of capital provided by accelerators is not available, we used the value of in-kind services provided by the program as an investment figure.

The reason for including all this data — instead of merely VC data — is that seed funding in the form of acceleration, angels and government funding plays an important role in stimulating nascent sectors.