Executive summary

- This report develops a new Foreign Investment Uncertainty Index for Australia based on a keyword search of major Australian newspapers from 1997 through to the end of 2020.

- The index finds that foreign investment uncertainty nearly doubled for the four quarters of 2020 compared to the average for 2019.

- This increase is attributable in part to the government’s reduction in the foreign direct investment (FDI) review threshold to zero dollars as a response to the pandemic and the introduction of a new national security test.

- In previous years, uncertainty was driven by specific high-profile transactions that tested the operation of Australia’s foreign investment framework.

- The single biggest increase in the index occurs in the context of the Australia-US bilateral investment relationship. This is due to the treasurer’s rejection of Archer-Daniels-Midland’s (ADM) bid for Graincorp in 2013.

- In 2020, the gross inflow of FDI from foreign investors fell to only half the average of the five years ending in 2019, with global FDI flows in retreat due to the pandemic downturn.

- The industry sectors most affected by foreign investment uncertainty in Australia are the energy and resources sectors, reflecting their high levels of foreign ownership and high-profile cross-border acquisitions that are more likely to become politicised.

- Applying the same methodology to the United States suggests the United States has historically much lower levels of foreign investment uncertainty due to a more narrowly focused regulatory review process.

- However, the United States also shows a dramatic rise in foreign investment uncertainty due to changes in legislation expanding the scope of its FDI screening process in 2018, as well as the effect of the Trump administration’s policies.

- The increased prominence of national security concerns in the regulation of FDI in Australia and the United States is likely to see elevated levels of policy-related uncertainty in both countries, although policy and legislative changes can also have the effect of reducing uncertainty.

- Given the close security relationship between Australia and the United States, the increased prominence of national security concerns in FDI regulation is expected to drive further growth in the bilateral investment relationship with Australia’s top investment partner.

- An increase in the Foreign Investment Uncertainty Index for Australia has a negative effect on private investment spending in Australia, although the effect is smaller and less persistent than for the Baker, Bloom and Davis Economic Policy Uncertainty Index.

- There is also a small effect from the index on the risk premium on Australia’s sovereign debt, although this effect is not statistically significant.

Introduction

Australia’s regulation of inward foreign direct investment (FDI) has often drawn criticism for creating uncertainty for foreign investors, as well as for Australians looking to sell their assets to foreigners. Much of this uncertainty arises from the power the Foreign Acquisitions and Takeovers Act (FATA) 1975 gives to the treasurer to reject foreign acquisitions that are deemed to be ‘contrary to the national interest.’ This discretionary authority is unpredictable in its application and can lead to the politicisation of cross-border investment transactions.

In 2020, the scope of the investment screening process was expanded with a new national security test designed to capture transactions of concern that would not otherwise trigger the existing national interest test. The government branded these changes as the most significant in 20 years.1 The new national security test reflects recommendations made by the United States Studies Centre (USSC) report, Deal-breakers? Regulating foreign direct investment for national security in Australia and the United States.2 However, our report recommended any new national security test should replace the existing national interest test which is based on broader economic and other criteria.

In response to the COVID-19 pandemic, the Australian Government also temporarily lowered the monetary threshold for the scrutiny of foreign acquisitions to zero dollars. This expanded the scope of the existing regulatory framework to effectively encompass all prospective foreign acquisitions.3 The decision reflected concerns the pandemic downturn might lead to the opportunistic acquisition of distressed Australian firms by foreign interests. It led to a substantial increase in the workload of the Foreign Investment Review Board, as well as delays in decision-making. The pandemic saw a sharp fall in foreign investment inflows, with gross inflows from foreign investors in 2020 representing less than half those seen on average in the five years from 2014 to 2019.4

This report develops a new Foreign Investment Uncertainty Index that seeks to quantify and measure over time the extent of regulatory, political and policy uncertainty around foreign direct investment in Australia.

The Organisation for Economic Co-operation and Development (OECD) has produced a widely referenced measure of the restrictiveness of FDI regulation across countries. This measure shows Australia to be a relatively restrictive jurisdiction for foreign investment compared to its peers. This is largely due to the operation of its investment screening process.5 The Productivity Commission has used this measure to quantify the cost of this regulation in terms of lost foreign investment and economic activity.6 However, the OECD measure only captures the de jure regulatory framework. It does not necessarily measure uncertainties that arise from its application.

This report develops a new Foreign Investment Uncertainty Index that seeks to quantify and measure over time the extent of regulatory, political and policy uncertainty around foreign direct investment in Australia. The index follows similar measures of economic policy uncertainty developed by Baker, Bloom and Davis7 in measuring the appearance of keywords relating to uncertainty and Australia’s foreign investment framework in newspapers.

The index developed here finds that the average level of foreign investment uncertainty in 2020 was nearly double what was seen over the four quarters of 2019. The increase in 2020 is attributable to the government’s reduction in the FDI review threshold to zero dollars and the introduction of the new national security test. In previous years, uncertainty was mainly driven by specific high-profile transactions which tested the operation of Australia’s foreign investment framework; whereas in 2020, changes in the framework itself generated the most uncertainty. Foreign investment uncertainty changed little in the decade from 1997-2007 but rose sharply from 2008 in the wake of the financial crisis and the regulatory response to increased Chinese direct investment in Australia.

To put Australia’s foreign investment uncertainty in context, this report searches for the same uncertainty keywords in United States newspapers, as well as terms relating to the operation of the US regulatory framework that are analogous to those in Australia. In contrast to Australia, the report finds negligible levels of measured policy uncertainty in the United States, reflecting the narrower scope and application of the US regulatory regime. This partly explains the appeal of the United States as an investment destination for Australian business.

However, like Australia, there is evidence of increasing uncertainty in recent years as the United States expands the scope of its framework due to national security concerns. The regulatory environment for foreign investment in Australia and the United States is likely to become more uncertain as national security concerns loom larger for policymakers in both countries. This is reflected in changes in FDI regulation. In principle, such legislative changes could both increase and decrease uncertainty and the index allows us to track these effects. Given the close security alliance between Australia and the United States, these changes are likely to drive growth in the already strong bilateral investment relationship despite uncertainty.

An increase in the Foreign Investment Uncertainty Index is shown to have a negative effect on private investment spending in Australia, although the effect is smaller and less persistent than for the broader Economic Policy Uncertainty Index. Foreign investment uncertainty affects a smaller number of economic decision-makers relative to broader measures of uncertainty. There is also a small, but not statistically significant, effect on the risk premium on Australian sovereign debt.

Measuring foreign investment uncertainty

Until recently, it was difficult to measure economic policy uncertainty. However, advances in online databases and computing power have made new methodologies based on searches for keywords relating to uncertainty and economic policy more feasible. The Economic Policy Uncertainty Index developed by Baker, Bloom and Davis has demonstrated significant explanatory power for business cycle dynamics not found in other economic variables. In a previous USSC report, I showed how measures of economic policy uncertainty for Australia and the United States explain exchange rates and interest rates, as well as cross-border trade and investment.8

Policy-specific uncertainty measures have also been developed using the same methodology. Foreign direct investment policy is an obvious candidate for this methodology. The keywords associated with the regulation of foreign acquisitions are highly specific to the operation of the legislative and policy framework for FDI, making the identification of relevant newspaper articles relatively straightforward and unambiguous. It is also widely acknowledged the legal regulatory framework, as measured by the OECD restrictiveness index, does not always reflect its operation in practice. The in-principle restrictiveness of the regime may be less important to economic outcomes than the uncertainty it creates. Policy uncertainty can itself be a costly barrier to cross-border transactions and a form of implicit protectionism.

To construct the index, I search leading Australian newspapers for keywords relating to both uncertainty and foreign investment policy and legislation. The newspapers included in the sample are The Australian, The Australian Financial Review, The Sydney Morning Herald, The Age and The Canberra Times. Both print and online editions were searched. The sample period is from the beginning of 1997 to the end of 2020. The Australian newspaper only appears in the Factiva database from the middle of 1996. Given the importance of its coverage of issues related to foreign investment, it was considered essential to include it in the measure, even though a longer sample could have been obtained from its exclusion.

The keywords used in the search are shown in Table 1. Hashtags followed by a number are used to denote the number of letters that vary after a word stem. For example, reject#3 captures ‘reject,’ ‘rejected’ and ‘rejection.’ A question mark allows substitution for alternative spellings.

Table 1. Uncertainty and foreign investment keywords

|

Uncertainty keywords |

Australian foreign investment keywords |

|

uncertain#2 |

Foreign Investment Review Board |

|

confus#3 |

FIRB |

|

discretion |

foreign invest#4 |

|

reject#3 |

foreign acquisition |

|

surpris#3 |

foreign takeover |

|

delay#2 |

national interest test |

|

politici?ed |

contrary to the national interest |

|

block#2 |

national security test |

|

secre#2 |

|

|

non-transparent |

|

|

pandemic |

|

The foreign investment keywords are mostly unique to the context of FDI regulation. The uncertainty keywords include words that capture both uncertainty and policy decisions likely to increase uncertainty. ‘Pandemic’ is included as an uncertainty keyword because the pandemic itself gave rise to considerable uncertainty, but also to capture changes in foreign investment policy related to the pandemic.

The search routine requires at least one uncertainty keyword to appear in the same paragraph (typically the same sentence) as at least one foreign investment policy keyword. Duplicate stories are eliminated from the count. The Baker, Bloom and Davis Index is normalised by the total number of stories, but such normalisation made little difference to the measure developed here and so only the unscaled story count is used. The unscaled story count was then standardised and normalised to a historical average equal to 100. The index is calculated on a quarterly basis.

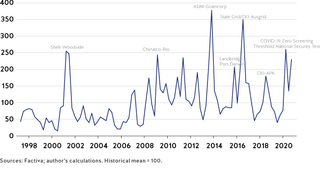

Figure 1 shows the resulting index annotated with some of the high-profile rejections of cross-border acquisitions that have likely contributed to the uncertainty measured by the index.

Figure 1. Foreign Investment Uncertainty Index — Australia

The index shows remarkable stability over the decade from 1997 to 2007, punctuated only by the controversy over Treasurer Peter Costello’s decision to reject Royal Dutch Shell’s bid for Woodside Petroleum in 2001. This was considered an unprecedented decision at the time and results in one of the largest increases in the index.

Foreign investment uncertainty increased in the wake of the Global Financial Crisis in 2008 and following an influx of Chinese FDI into the resources, agricultural and property sectors. This uncertainty led the government to clarify the application of the foreign investment framework. However, the index indicates that these efforts resulted in more, rather than less, uncertainty. The failed bid by Chinalco to raise its stake in Rio Tinto in 2009 exemplifies confusion in Australia’s FDI regulation at the time.9 The Archer-Daniels-Midland (ADM) — Graincorp decision in 2013 results in the single biggest increase in the index. This is perhaps because it was contrary to the advice of regulators to the treasurer and occurred in the context of the otherwise stable Australia-US investment relationship.

It should be noted that the index is not a pure measure of uncertainty and may not capture the cumulative effect of foreign investment uncertainty over time. Causality could run from foreign investment to the index or run in both directions. Statistical tests reported in the appendix suggest the index is predicted by other economic variables and so may be partly endogenous.

Furthermore, the index does not necessarily capture decisions about FDI that are made in secret and therefore are never captured on the public record. In March 2020, Treasurer Josh Frydenberg said:

“I actually have rejected a number of proposed acquisitions, some of which you know about and some of which you don’t. And the reason why you don’t is because the application comes in, I assess it and I say no and then they withdraw that application before it ever sees the light of day.”10

According to media reports, Chinese Government-backed cross-border acquisitions have been the subject of an informal Australian Government ban since the beginning of the pandemic, but this may not be fully reflected in the index.11 Chinese cross-border acquisitions in Australia fell to $2.6 billion in 2019 and just $1 billion in 2020 compared to $16 billion in 2016, according to one database.12

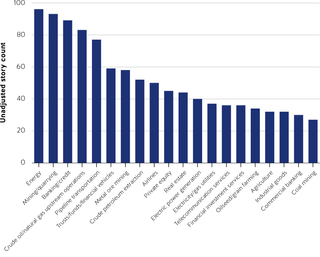

Industry sectors most affected by foreign investment uncertainty

The Factiva database classifies stories by industry, although the industry classification scheme mixes industry sectors and sub-sectors. Based on unadjusted story counts, it is possible to identify those industries and sub-sectors most affected by foreign investment uncertainty from the beginning of 1997 through to the end of 2020. This means a given story could potentially reference more than one industry or sector, or not be sector-specific and therefore not be counted by industry. The unadjusted story counts shown in Figure 2 need to be interpreted with some caution.

Figure 2. Top 20 industries affected by foreign investment uncertainty

The energy and resources sectors feature most prominently. This reflects the high level of foreign ownership of this sector which has consequently also featured some high-profile and controversial cross-border acquisitions. Financial services also feature prominently, although this may reflect their role as intermediaries rather than as targets for foreign acquisition.

Foreign investment uncertainty in the United States

The same methodology can be applied to the United States by searching the same uncertainty keywords alongside terms specific to the operation of the US statutory framework for regulating foreign direct investment. The same US newspapers included in the Baker, Bloom and Davis Economic Policy Uncertainty Index are searched.13 The search terms for the US foreign investment framework are shown in Table 2.

Table 2. US foreign investment keywords

|

Committee on Foreign Investment in the United States |

|

CFIUS |

|

Foreign Investment Risk Review Modernization Act |

|

FIRRMA |

|

Foreign Investment and National Security Act |

|

FINSA |

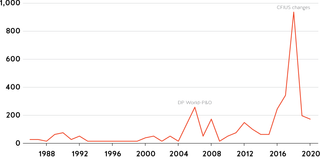

The index for the United States is shown in Figure 3.

Figure 3. Foreign Investment Uncertainty Index — United States

The US search, covering a larger number of titles over a longer period of time, returns negligible results for most years and far fewer results than Australian newspapers. For example, no stories are captured between 1992 and 2000 (the results above have been scaled by one, as well as being standardised and normalised to a historical mean of 100). The stability in the index for much of its history points to a more predictable regulatory environment for foreign investment than found in Australia.

However, there is a dramatic increase in the number of stories towards the end of the sample period associated with changes to the US regulatory regime in 2018, as foreshadowed in my 2018 USSC Deal-breakers report with Jared Mondschein. In this case, the keyword search likely captures the prospective operation of the new regulatory framework. President Trump’s broader economic and trade policies also likely increased investment uncertainty between 2017 and 2020.

As in Australia, controversial foreign acquisitions, such as Dubai Ports World’s bid for several US ports in 2006, are shown to be associated with an uptick in uncertainty. Overall, the regulation of cross-border acquisitions has a much lower salience in the United States than in Australian media. This, in turn, reflects a lower likelihood for politicised cross-border acquisitions due to the operation of the US regulatory framework. It could also reflect cultural differences between the United States and Australia in perceptions of foreign investment such that foreign investment is inherently more controversial, and therefore more newsworthy, in Australia.

The economic effects of foreign investment uncertainty

As Figure 1 suggests, the Australian index shows the most volatility in association with high-profile and controversial cross-border acquisitions that are rejected under Australia’s foreign investment framework. To that extent, the index clearly captures the operation of that framework. However, such high-profile acquisitions and subsequent rejections are more likely to arise when economic activity and overall FDI are relatively strong.

The index may be partly endogenous, limiting its explanatory power for other economic variables such as foreign and domestic investment. The economic effects from foreign investment uncertainty are likely to arise with a lag and have persistent effects, but these dynamics can be difficult to capture statistically. The modelling that follows should thus be treated as indicative rather than definitive. Its main function is to show that the index can be given economic interpretation, as well as being descriptive of the operation of Australia’s foreign investment framework.

The index does not have much explanatory power for foreign direct investment transactions. In evaluating the economic effects of the index, it is not clear that foreign direct investment is the variable of interest. Foreign direct investment is the transfer of ownership of Australian equity capital to foreign persons and the timing of the transfer may be only loosely related to other economic variables. In and of itself, the transfer does not necessarily have significant economic effects in the short run, although it is widely acknowledged foreign ownership can lead to significant economic benefits over time. Again, these benefits can be difficult to capture statistically by focusing on short-run dynamics.

An arguably more relevant economic variable is private investment spending. It should be recalled that around 19 per cent of capital expenditure in Australia is by firms with at least 10 per cent foreign ownership,14 which is the threshold used by the Australian Bureau of Statistics (ABS) for defining ‘foreign ownership’ when compiling FDI data. Foreign investment uncertainty could also affect the investment activity of wholly Australian-owned firms. For example, an Australian-owned firm that is prevented from selling its equity to a foreign entity may be unable to realise the full value of that equity, reducing the amount of other investment it is able to undertake in future. Foreign investment uncertainty may serve to devalue the stock of domestic equity capital, thereby increasing collateral and borrowing constraints. Foreign investment uncertainty may depress the investment activity of domestic as well as foreign firms.

In the appendix, I model the relationship between the Foreign Investment Uncertainty Index and the Economic Policy Uncertainty Index, the real effective exchange rate, the spread of 10-year Australian Government bonds over 10-year US Treasuries, real GDP, and private gross fixed capital formation. The modelling approach is similar to those that are used to evaluate the economic effects of economic policy uncertainty more generally.

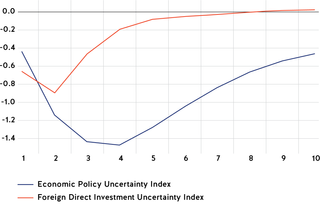

The main finding is shocks to the Foreign Investment Uncertainty Index have smaller but still economically significant effects on private investment spending compared to economic policy uncertainty more generally. A one standard deviation shock to the Foreign Investment Uncertainty Index lowers private investment by 0.9 per cent after two quarters. By way of comparison, a one standard deviation shock to the Economic Policy Uncertainty Index lowers private investment by 1.5 per cent after four quarters (Figure 4). The larger and more persistent effect of the EPU Index likely reflects its impact on a much larger range of consumer and business decision-makers than FDI uncertainty. The number of decision-makers directly impacted by foreign investment uncertainty is much smaller than for economic policy uncertainty.

Figure 4. Dynamic response of private gross fixed capital formation to one standard deviation shocks to the Australian Economic Policy Uncertainty Index and Foreign Direct Investment Uncertainty Index (%)

Shocks to the Foreign Investment Uncertainty Index also have a small but not statistically significant effect (plus three basis points) on the Australian 10-year yield spread over US Treasuries, which can be interpreted as a risk premium. It should be noted this is the same order of magnitude as the estimated reduction in the risk premium from the Australia-US Free Trade Agreement (AUSFTA). This interpretation can be turned around to say that the AUSFTA was equal to a one standard deviation reduction in foreign investment uncertainty, as measured by the index.

While foreign investment uncertainty and economic policy uncertainty do not individually predict investment spending, they do predict investment spending when tested jointly with other variables in the model (see Appendix). Additionally, the Economic Policy Uncertainty Index predicts the Foreign Investment Uncertainty Index, indicating that the latter may capture elements of general policy uncertainty. Other model variables can also jointly predict the Foreign Investment Uncertainty Index, indicating that the index may be partly endogenous. The dynamic effects of FDI uncertainty may be difficult to capture in a simple, atheoretical model of this type. However, the results are consistent with foreign investment policy uncertainty having a role in the determination of domestic capital formation.

Conclusion

The Foreign Investment Uncertainty Index shows foreign investment uncertainty in Australia has increased over time. After showing little change over the decade from 1997 to 2007, there was a sharp increase in uncertainty from 2008 onwards coinciding with a pick up in Chinese FDI in Australia. This in turn prompted changes in Australia’s regulatory regime which likely increased uncertainty by expanding the scope of the existing regulatory framework. Although Chinese investment in the resources sector triggered much of this uncertainty, investment by traditional investment partners has not been immune. The treasurer’s rejection of ADM’s bid for Graincorp in 2013, against the advice of domestic regulators, shows that the otherwise stable Australia-US bilateral investment relationship can also get caught up in domestic politics.

The Foreign Investment Uncertainty Index shows foreign investment uncertainty in Australia has increased over time. After showing little change over the decade from 1997 to 2007, there was a sharp increase in uncertainty from 2008 onwards coinciding with a pick up in Chinese FDI in Australia.

By contrast, foreign investment uncertainty has a much lower salience in the US media. This may reflect different cultural attitudes to foreign investment and thus the propensity to report on the regulation of foreign acquisitions. More importantly, it reflects a statutory framework for FDI regulation which is much narrower in scope. However, the United States does show a significant increase in measured uncertainty in recent years, reflecting the growing importance of national security concerns and changes to the US legislative framework designed to address these concerns, as well as the uncertainties associated with President Trump’s economic and trade policies between 2017 and 2020. The increased prominence of national security concerns in FDI regulation in Australia and the United States is likely to drive further growth in the bilateral investment relationship given the close security ties between the two countries.

Shocks to the Foreign Investment Uncertainty Index have a negative effect on private capital expenditure, although a smaller and less persistent effect than that of broader economic policy uncertainty shocks, as measured by the Economic Policy Uncertainty Index. The role of foreign-owned firms in domestic investment spending is likely to be the main transmission mechanism, although foreign investment uncertainty can also devalue the stock of domestic equity capital, prompting an increase in collateral and borrowing constraints on domestic firms, and a reduction in their investment spending. There is also a small positive effect from such shocks on the Australian sovereign risk premium, although this effect is not statistically significant. While the index developed in this report clearly reflects the operation of Australia’s foreign investment framework, the economic effects of such regulation are likely to have complex dynamics that are difficult to capture in simple models of this type.

Appendix: Macroeconomic effects of the Foreign Investment Uncertainty Index

I examine the macroeconomic effects of the Foreign Investment Uncertainty Index for Australia in the context of a recursively-identified vector autoregression (VAR) model. The variables in the model include the Australian Economic Policy Uncertainty Index (aepu), the Foreign Investment Uncertainty Index (fiui) developed in this report, the Australian dollar real effective exchange rate (reer), the spread of the Australian Government 10-year bond yield over 10-year US Treasuries (spread), Australian real GDP (gdp) and Australian private gross fixed capital formation (gfcf). All variables except spread are in log form and enter in levels of the variable.

Variables are ordered as listed above, reflecting their assumed relative speed of adjustment. This allows us to recover orthogonal shocks using a Cholesky decomposition. A lag order of two is imposed, which ensures a parsimonious specification, while narrowly passing tests for the absence of serial correlation in the residuals. The adjusted sample period is Q3 1998 to Q4 2020.

The Australian Economic Policy Uncertainty Index is included in the model since it has previously been shown to have explanatory power for some of the variables in the system and to ensure that foreign investment uncertainty has effects distinct from more general policy uncertainty.

The effect of one standard deviation shocks to aepu and fiui on gfcf have already been shown in Figure 4. Investment spending declines 1.5 per cent after four quarters in response to economic policy uncertainty shocks, while foreign investment uncertainty shocks lower investment by 0.9 per cent after two quarters. The larger and more persistent effect of economic policy uncertainty can be attributed to the more generalised uncertainty it represents, affecting a larger range of economic decision-makers. Shocks to economic policy uncertainty increase foreign investment uncertainty, but there is not a statistically significant effect of foreign investment uncertainty on broader policy uncertainty. This is consistent with expectations that causality should flow from broader uncertainty to policy-specific uncertainty, rather than the other way around.

Other impulse responses are mostly consistent with economic theory. Shocks to both measures of uncertainty add three to five basis points to the yield spread, although this effect is not statistically significant. While economic policy uncertainty shocks lower the real effective exchange rate by 1.9 per cent after two quarters, the fiui does not have a statistically insignificant effect on the reer. Shocks to the yield spread raise the real effective exchange rate by 1.6 per cent, which is consistent with the theory. Real GDP shocks raise the level of private investment by 1 per cent after two quarters.

In addition to impulse response analysis, we can consider Granger causality and block exogeneity tests to identify the causal relationships among the variables. Since the variables are in levels, the Toda and Yamamoto15 procedure is used to ensure the validity of the Wald tests as the basis for inference. The test statistics are shown in Table A1.

The test statistics indicate that the Foreign Investment Uncertainty Index does not have individual predictive power for other variables in the system, although it is jointly significant in explaining private investment spending. It is noteworthy that the other variables in the system jointly, and in the case of the Economic Policy Uncertainty Index, individually predict the Foreign Investment Uncertainty Index. This suggests the latter may be partly endogenous to other variables in the system. Given that investment spending is driven by the other economic variables in the system, it is likely to assume greater media salience in association with those variables.

These test statistics are highly sensitive to model specification and so should be taken as indicative only. However, they are consistent with the Foreign Investment Uncertainty Index being economically interpretable in the context of a simple, atheoretical model.

Table A1. VAR Granger causality and block exogeneity Wald tests based on the Toda-Yamamoto procedure

|

Dependent variable: LOG(AEPU) |

|||

|

Excluded |

Chi-sq |

df |

Prob. |

|

LOG(FIUI)*100 |

3.669056 |

2 |

0.1597 |

|

LOG(REER)*100 |

0.728910 |

2 |

0.6946 |

|

SPREAD |

1.780684 |

2 |

0.4105 |

|

LOG(GDP)*100 |

0.841113 |

2 |

0.6567 |

|

LOG(GFCF)*100 |

0.667335 |

2 |

0.7163 |

|

All |

7.902811 |

10 |

0.6383 |

|

Dependent variable: LOG(FIUI) |

|||

|

Excluded |

Chi-sq |

df |

Prob. |

|

LOG(AEPU)*100 |

6.230603 |

2 |

0.0444 |

|

LOG(REER)*100 |

4.900245 |

2 |

0.0863 |

|

SPREAD |

2.807625 |

2 |

0.2457 |

|

LOG(GDP)*100 |

2.480859 |

2 |

0.2893 |

|

LOG(GFCF)*100 |

3.397982 |

2 |

0.1829 |

|

All |

27.85395 |

10 |

0.0019 |

|

Dependent variable: LOG(REER) |

|||

|

Excluded |

Chi-sq |

df |

Prob. |

|

LOG(AEPU)*100 |

1.040879 |

2 |

0.5943 |

|

LOG(FIUI)*100 |

0.095762 |

2 |

0.9532 |

|

SPREAD |

4.568478 |

2 |

0.1019 |

|

LOG(GDP)*100 |

0.080017 |

2 |

0.9608 |

|

LOG(GFCF)*100 |

5.919968 |

2 |

0.0518 |

|

All |

11.88200 |

10 |

0.2930 |

|

Dependent variable: SPREAD |

|||

|

Excluded |

Chi-sq |

df |

Prob. |

|

LOG(AEPU)*100 |

0.666386 |

2 |

0.7166 |

|

LOG(FIUI)*100 |

0.551052 |

2 |

0.7592 |

|

LOG(REER)*100 |

0.624636 |

2 |

0.7317 |

|

LOG(GDP)*100 |

2.900787 |

2 |

0.2345 |

|

LOG(GFCF)*100 |

4.303354 |

2 |

0.1163 |

|

All |

9.703373 |

10 |

0.4669 |

|

Dependent variable: LOG(GDP) |

|||

|

Excluded |

Chi-sq |

df |

Prob. |

|

LOG(AEPU)*100 |

3.235905 |

2 |

0.1983 |

|

LOG(FIUI)*100 |

1.703566 |

2 |

0.4267 |

|

LOG(REER)*100 |

1.316651 |

2 |

0.5177 |

|

SPREAD |

0.921976 |

2 |

0.6307 |

|

LOG(GFCF)*100 |

0.081110 |

2 |

0.9603 |

|

All |

8.269873 |

10 |

0.6025 |

|

Dependent variable: LOG(GFCF) |

|||

|

Excluded |

Chi-sq |

df |

Prob. |

|

LOG(AEPU)*100 |

2.823100 |

2 |

0.2438 |

|

LOG(FIUI)*100 |

0.567399 |

2 |

0.7530 |

|

LOG(REER)*100 |

2.396634 |

2 |

0.3017 |

|

SPREAD |

8.516347 |

2 |

0.0141 |

|

LOG(GDP)*100 |

4.652148 |

2 |

0.0977 |

|

All |

26.74002 |

10 |

0.0029 |